When Wells Fargo disclosed a $37 million regulatory penalty in Q1 2024 due to post-closing audit failures, as reported by HousingWire, the message to the industry was clear: Traditional audit frameworks are no longer keep pace in a digital-first mortgage landscape. This inflection point has accelerated the adoption of advanced technologies, transforming post-closing audits from regulatory obligations into a strategic lever for performance, operational efficiency, and competitive advantage.

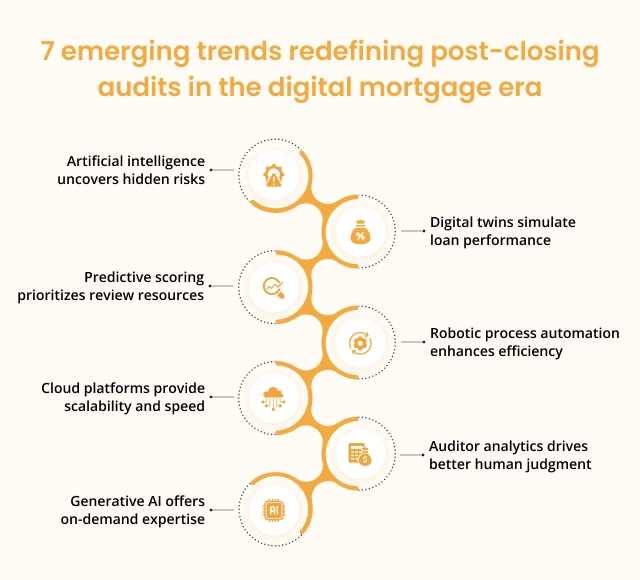

Here are seven transformative trends that are redefining how forward-thinking lenders approach post-closing quality control.

1. Artificial intelligence uncovers hidden risks

AI is now central to loan defect detection, offering a level of accuracy and insight that surpasses manual reviews. A leading mortgage lender reported a 61% reduction in defect escape rates in 2023 after implementing machine learning technologies.

Artificial Intelligence Uncovers Hidden Risks AI has become a cornerstone of post-closing audits, offering a level of accuracy and insight that surpasses manual methods

- Automated discrepancy detection: Identifies inconsistencies between loan estimates and closing disclosures, flagging potential pricing errors or compliance breaches.

- Pattern recognition engines: Analyze error trends across loan officer performance to expose recurring systemic issues.

- Calculation accuracy verification: Ensures precision in complex calculations such as ARM and APR, reducing manual oversight errors.

- Emerging threat detection: Spots new fraud schemes by benchmarking current files against historical data.

2. Digital twins simulate loan performance

Digital replicas of loan files allow lenders to simulate real-world outcomes and correct errors before funding. United Wholesale Mortgage prevented over half of the potential defects during a recent pilot of this technology.

- Pre-funding validation: Verifies compliance with investor guidelines before loan finalization.

- Regulatory impact modeling: Tests how policy updates affect existing pipelines, helping triage high-risk files.

- Training environments: Uses anonymized loan data to train underwriters through realistic scenarios.

- Exception forecasting: Predicts post-closing issues based on early-stage origination patterns.

3. Predictive scoring prioritizes audit resources

Data-driven scoring systems optimize resource allocation during the audit process. Flagstar Bank reduced unnecessary audits by 44% through predictive models.

- Risk-based triage: Directs complex files to senior auditors, allowing clean loans to be cleared efficiently.

- Vendor monitoring: Evaluates third-party partners based on historical documentation quality.

- Geographic risk mapping: Pinpoints regions prone to title or appraisal anomalies.

- Compliance trend forecasting: Uses enforcement data to anticipate future regulatory hot spots.

4. Robotic process automation enhances efficiency

RPA bots handle routine tasks with perfect consistency. Guild Mortgage added capacity for 800 more weekly loans through automation.

- Cross-system reconciliation: Ensures alignment across LOS, POS, and servicing platforms without manual intervention.

- Document completeness review: Verifies signatures, initials, and required disclosures before funding.

- Fee tolerance checks: Confirms that charges comply with allowable variances.

- Smart exception routing: Directs defects to specialized teams based on category and severity.

5. Cloud platforms provide scalability and speed

Cloud-native solutions support high-volume processing with flexible infrastructure. A top-five lender processed over 22,000 refinances in three days during the 2023 rate drop using a cloud platform.

- Elastic resource allocation: Automatically adds computing power during high-volume periods.

- Real-time collaboration: Enables distributed audit teams to work on files simultaneously.

- Instant guideline updates: Pushes compliance changes directly to all users.

- Legacy integration: Connects modern systems to older infrastructure via secure APIs.

6. Auditor analytics drives better human judgment

Data analytics are now being applied to human auditors, creating a feedback loop that improves accuracy and consistency. One regional credit union improved defect detection by 33 percent after implementing performance analytics.

- Decision consistency tracking: Highlights inconsistencies in how defects are classified across the team.

- Efficiency mapping: Identifies bottlenecks in the review process.

- Fatigue analysis: Measures how performance fluctuates over time of day.

- Targeted training insights: Pinpoints areas where reviewers need additional support or education.

7. Generative AI offers on-demand expertise

Generative AI systems are reshaping compliance support by offering real-time, contextual insights. Mr. Cooper reduced legal consultation by 55% after adopting generative tools.

- Regulatory interpretation: Clarifies complex rules and how they apply to specific loans, backed by source citations.

- Remediation advising: Suggests actionable steps to correct identified issues.

- Custom checklist generation: Creates loan-specific audit templates based on file characteristics.

- Knowledge retention engines: Captures the judgment patterns of senior auditors for future reference and training.

Conclusion: A strategic evolution in quality control

The digital mortgage era demands a rethinking of quality assurance, shifting from retrospective reviews to proactive, data-driven audits. These 7 trends are not just enhancing compliance, they are enabling lenders to deliver higher-quality loans faster and at scale. For today’s industry leaders, the question is no longer whether to adopt these tools but how quickly they can integrate them to remain competitive in a market where precision and agility define success.