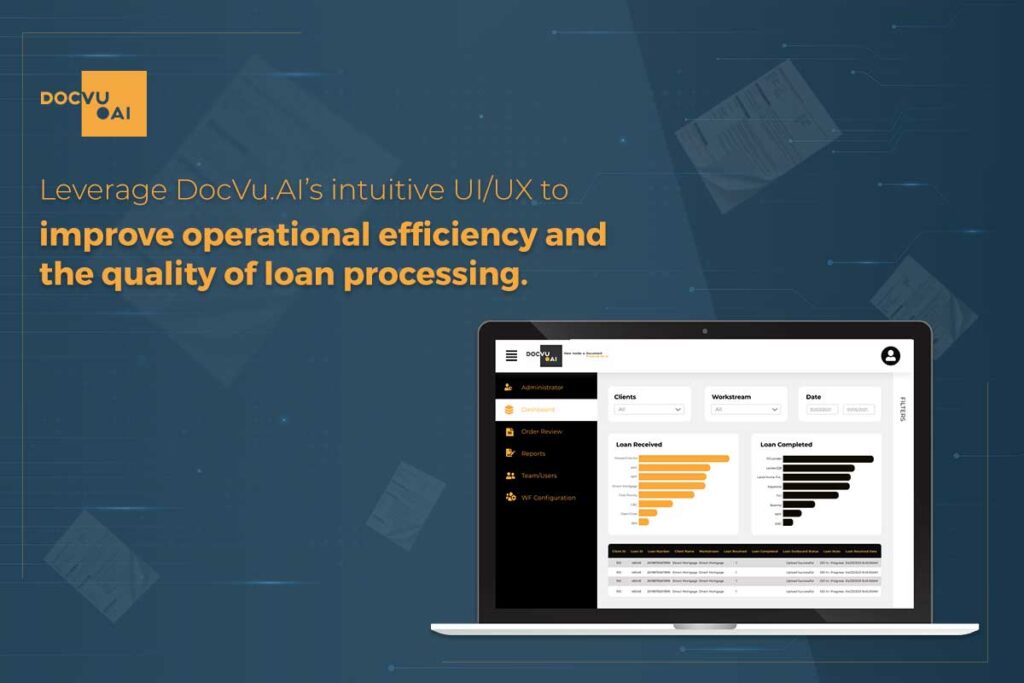

Quality user experience through intuitive UI/UX has become vital in today’s full-scale digital ecosystem. Document processing solutions in the mortgage industry need to create more streamlined workflows and intelligent indicators to make mortgage processing more seamless to help cut down on the average number of days it takes to process the loans. The enhanced user interface of DocVu.AI creates a more simple, consistent, and familiar experience which helps in enhancing productivity and satisfaction for the employees.

STREAMLINING –

Different users are looking to access key content and functionality without much complexity. DocVu.AI’s design decisions are streamlined to reflect user priorities and help them accomplish key tasks. Apart from providing importance to the key tasks for each type of user, it makes sure that it doesn’t fill up the white spaces with unnecessary information taking the user’s attention away from key functionality and content, impeding efficiency.

REMOVING USABILITY ROADBLOCKS –

Two factors that constrain efficiency are the quality of the content and the quality of the interaction design. Many different usability factors go into the solution’s great interaction design, such as proper affordances, establishing a sense of place, and clear relationships within the page content. DocVu.AI allows users to navigate through different tasks quite seamlessly which improves the productivity of the users with a better user experience.

WORK FROM ANYWHERE, ANYTIME –

DocVu.AI is built to enable users to work from anywhere with the flexibility to customize the solution as per the company’s policies. A company may want to keep sensitive information not accessible by a certain group of users working from out of the office. The solution has been designed to work with extremes and so it will cater to all the use cases when it comes to working anywhere.

ERROR HIGHLIGHTING –

Intelligent document processing has many stages where informing the users about the status of a certain step is vital to proceed further. Highlighting errors is an important function of an IDP solution – it helps identify errors due to missing documents, provides pending task notifications, and indicates discrepancies. DocVu.AI does this through various color codes and detailed content for each instance through an exclamation mark (!).

ENHANCED EMPLOYEE PRODUCTIVITY AND SATISFACTION –

DocVu.AI, with its deep expertise in the mortgage industry for over 30 years, configures workflows and rules in a way that complements the functioning of the employees. From exception handling documents to error highlighting to customized rules for staff, the solution goes the extra mile to ensure that the employees find it easy to use and are able to process more loan applications.