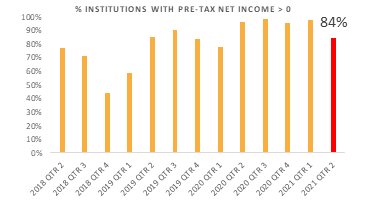

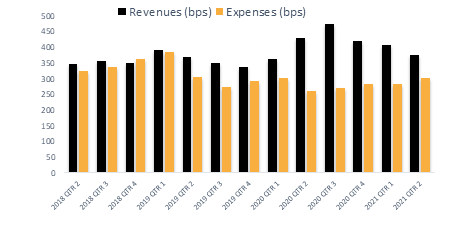

In Q2FY2021, 16% of mortgage banks reported a pre-tax loss. The primary factors for that were the high cost of operations and a plateau in revenues. For the last four quarters, the mortgage industry has seen healthy growth in revenues. US mortgage banks have adopted strategies to capture mortgage demand.

As revenue growth for the last three quarters is slowing, it becomes essential to revisit past strategies and align with today’s market scenarios. Organizations need to be more competitive to maintain their market share. The focus should be on how you can increase your mortgage product’s value proposition.

You can leverage operations to improve your mortgage product value proposition, impacting your top line and margins. The key difference that operations can make to mortgage is

- Qualify more applicants

- Increase applicant buying power

- Offer the most competitive rate

So let’s look at this from the lends of a Customer, Broker and the organization and arrive at key areas that can bring growth.

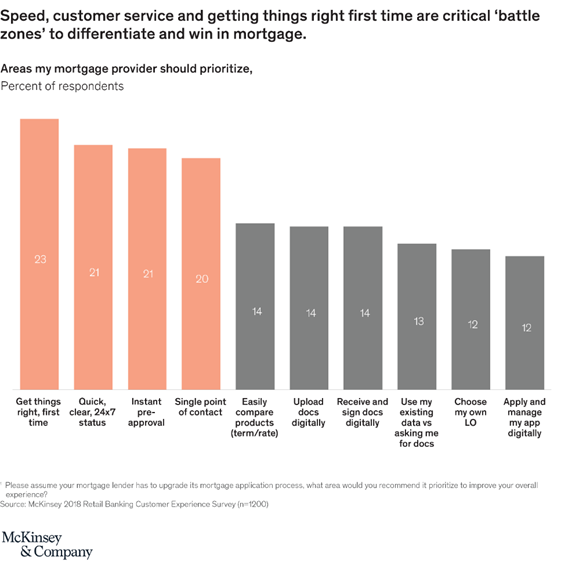

Customer’s priorities

- Get things right the first time – Customers want to sit once and finish the process of loan applications. While the mortgage application is a complicated process, it is essential to get all the required information at the beginning.

- Mortgage application Status updates – Customers want to know the detailed status of the application

- Quick pre-approval loans (with attraction mortgage offers)– Getting quick pre-approval is vital as this enables a customer to explore options to choose the right offer. So really, it should be a fast pre-approval with an attractive loan offer

- Paperless application – The percent of respondents who reported a paperless online mortgage process being important in choosing a mortgage lender or broker remained relatively high and unchanged from 2018 to 2019 (40 percent for home-purchase mortgages and 44 percent for refinances).

Brokers value

The importance of brokers is rising.

- The percentage of NMP survey respondents who applied for mortgage loans through brokers increased

- 42% in 2018 to 46% in 2019 for home-purchase mortgages

- 30% in 2018 to 38% in 2019 for refinances

- The percentage of NMP survey respondents who applied for mortgage loans directly through a bank or credit union decreased

- 54% in 2018 to 49% in 2019 for home-purchase mortgages

- 67% in 2018 to 61% in 2019 for refinances

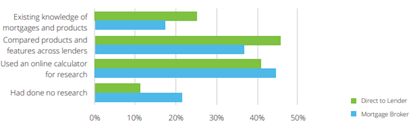

The primary factors that lead to customers choosing brokers are: –

- fewer customers are aware of the mortgage processes

- fewer customers are aware of mortgage products or comparisons done

- customers have a personal or prior relationship with a broker

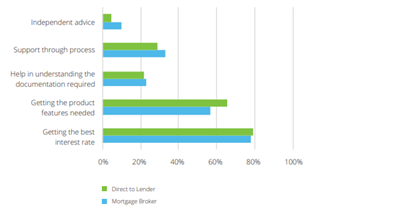

During the mortgage process, brokers add value to a customer in: –

- Getting the best interest rates

- Getting the product features needed

- Support through process

Organization

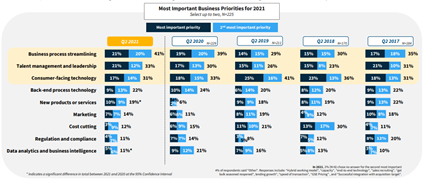

A survey responded by top executives in mortgage banks shows a story that mirrors the findings of the surveys for brokers and customers.

The top 4 priorities for mortgage organizations are: –

- Business process streamlining

- Talent management and leadership

- Customer-facing technology

- Back end process technology

Mapping it all together

| Customer demands | Broker priorities | Organization objectives | Solutions for Operations & tech |

| Get right the first time | Support through process

|

Business process streamlining

Back end process technology

|

An ability to classify the documents and map the documents and data to compliance requirements specific to each application will ensure all the documents are in place

An accurate mortgage specific document processing technology minimizes errors and facilitates the First time right |

| Mortgage application Status updates | Support through process

|

Customer-facing technology

Back end process technology

|

Tight integration with your application ecosystem will enable you to provide quick and accurate updates at every step that builds confidence in the customer about your value.

Configurable Business rules can trigger status emails and messages to customers automatically |

| Quick pre-approval loans with attraction mortgage offers | Get the product features needed

Get the best interest rates

|

Back end process technology

|

Accurate and fast Mortgage document processing brings the correct information early for underwriting which helps build a compelling loan offer to the customer before your competition

Accurate mortgage specific document processing technology minimizes errors reducing time to process and cost of review

A robust integration also ensures that all your teams work efficiently and with the correct data at the right time |

| Paperless application | Support through process

|

Customer-facing technology

Back end process technology |

Integration with CRMs & image capture technology can build a paperless application process; however, integration with data systems like credit reports, etc. will maximize the paperless application process and minimize customer effort for application |

Thank you