In the dynamic landscape of the mortgage industry, efficient document indexing is paramount. Navigating the mortgage industry’s intricate workflows, filled with extensive documentation, can often feel like an overwhelming task. The myriad of forms, documents, and attachments necessary for mortgage processing demand meticulous organization, especially given the sensitive nature of the information they contain. Mortgage lenders are well-acquainted with the burdensome nature of this task, highlighting a growing need for efficient mortgage document indexing services. Identifying essential indexing services is the critical first step for lenders seeking to streamline their processes. Partnering with a provider that leverages cutting-edge technology for comprehensive mortgage document management can empower lenders to take the lead in the competitive mortgage market.

The Problem

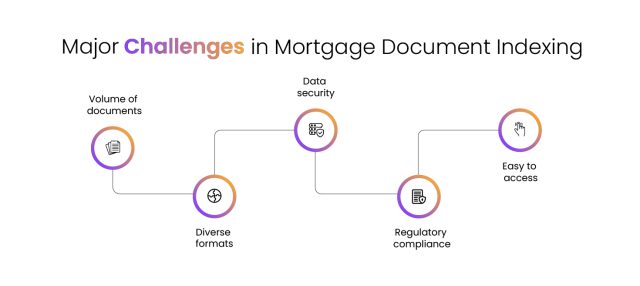

Document indexing in the mortgage industry encounters significant challenges. Managing vast document volumes, ranging from loan applications to legal forms poses organizational hurdles. Diverse formats, including digital, scanned, and physical documents, demand flexible indexing systems.

Navigating Challenges in Document Indexing for the Mortgage Industry

- One of the primary challenges is the sheer volume of documents involved in mortgage transactions. The diversity and quantity of documents require robust indexing systems, from loan applications and financial statements to legal contracts and property records.

- Furthermore, the varying formats of documents add complexity. Digital files, scanned documents, and physical paperwork all need to be seamlessly integrated into the

indexing process. This necessitates adaptable technologies and strategies to ensure

accuracy and accessibility. - Ensuring the security and confidentiality of sensitive information is another critical challenge. With data privacy regulations becoming increasingly stringent, mortgage

companies must implement rigorous protocols to safeguard client data during indexing and retrieval processes as per compliance and regulatory authorities’ requirements. - Talking about compliance with regulatory requirements is in itself a source of

constant concern. Mortgage industry players must stay abreast of evolving regulations and ensure that their document indexing practices align with legal standards. Failure to comply can lead to costly penalties and reputational damage. - Speed is also of the essence in the mortgage industry. Quick access to indexed documents is vital for timely decision-making concerning compliance and customer service. Delays or inefficiencies in the indexing process can result in missed

opportunities and customer dissatisfaction.

The Solution

Addressing these challenges requires a multi-faceted approach. Leveraging advanced technologies such as artificial intelligence (AI) and machine learning can streamline document indexing processes, improve accuracy, and enhance data security. Implementing robust encryption and access control measures can further fortify data protection.

Enhancing Document Indexing Through AI: A Multi-Faceted Approach with Intelligent Document Processing

Traditionally, mortgage document indexing and data extraction have been a time- consuming and labor-intensive task for lenders and their employees. However, by leveraging advanced digital tools, these challenges can be effectively and cost- efficiently addressed.

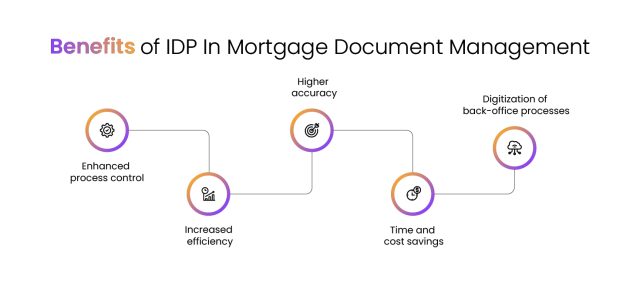

Here are some key benefits of using innovative technologies like intelligent document processing for mortgage document indexing and extraction.

Enhanced Process Control

Closing mortgage loans on time depends on various factors, and efficient document indexing is crucial. The digital shift in the mortgage industry has made manual systems obsolete, replacing them with faster, more efficient processes like intelligent document processing and smart indexing services which help lenders identify risks, spot process

bottlenecks, and resolve them with specialized solutions.

Reduced Effort, Increased Efficiency

Handling mortgage documents requires meticulous attention to detail, ensuring nothing

is overlooked. This often burdens the lender’s operations team. Automated mortgage

document indexing technologies like IDP streamline the classification process, making it much easier. By addressing a wide range of document-related issues intelligently, the entire mortgage life cycle becomes significantly more efficient.

Higher Accuracy

Repetitive and lengthy tasks are prone to errors. When employees are swamped with extracting and indexing large volumes of data, mistakes are bound to happen. AI tools

like intelligent document processing can quickly identify and eliminate these errors, resulting in more accurate documents. This improved accuracy enables mortgage lenders to make confident business decisions.

Time and Cost Savings

Time is money, especially in business. Mortgage lenders can benefit greatly from

exploring tools, processes, and technologies like intelligent document processing that save time and allow employees to focus on more critical aspects of the business. Over time, investing in technology like IDP can reduce the need for specialized staff and ongoing training, providing substantial cost benefits.

Digitization of Back-office Processes

Mortgage back-office operations involve managing a vast amount of scanned documents. Smart data capture tools and OCR software simplify tasks like splitting and uploading images to designated folders, verifying data, and accessing information from various records. Streamlining these back-office processes with such intelligent automation as IDP results in significant cost savings for lenders.

Conclusion

In conclusion, overcoming challenges in document management, such as efficient indexing, accuracy, and data security, necessitates a multi-faceted approach that combines innovative technologies with robust security measures. Intelligent document processing (IDP) powered by artificial intelligence (AI) and machine learning is transforming document indexing by automating categorization, organization, and metadata tagging based on content. These AI-driven systems enhance efficiency, accuracy, and adaptability, even as document complexity increases. Furthermore, AI strengthens data security through robust encryption and access control measures, thereby enhancing productivity, decision-making, and customer confidence in data privacy and security. Integrating AI into document management is essential for maintaining competitiveness and resilience in today’s digital era.

To experience the transformative power of AI in ‘Intelligent Automation’, connect with DocVu.AI