Finance teams across different industry verticals have largely overlooked the substantial potential of AI and ML to enhance productivity in accounts payable, despite acknowledging the power of digital transformation.

1* Reports show that AP automation with AI can reduce processing costs by 81%, accelerate processing times by 73%, and cut human errors by up to 40%.

These AI and ML-driven digital transformation solutions not only boost productivity but also eliminate human errors and detect fraud. In this blog, we will explore the transformative power of these technologies and their impact on addressing challenges in accounts payable.

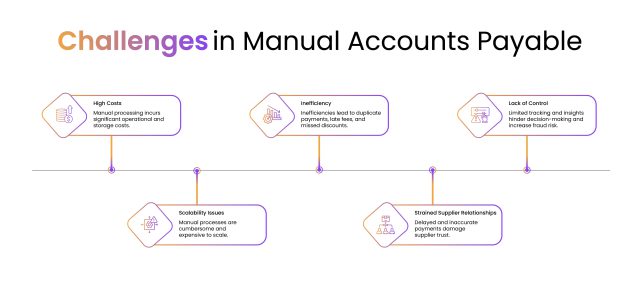

Challenges in Manual Accounts Payable: High Costs, Inefficiencies, and

Profitability Risks

Over the years, it has been recognized that the manual accounts payable process presents issues such as high operational and storage overheads, which result in increasing expenses. Furthermore, manual processing of accounts payable can result in repeated payments, late fines, and missed discounts, highlighting the inherent inefficiencies of such systems.

High Costs and Storage Overheads

Manual accounts payable (AP) processing can be costly due to higher operational and storage overheads. Handling and storing paper documents requires significant resources, driving up expenses and occupying valuable physical and digital space.

Inefficiency and Profitability Challenges

The manual accounts payable process often faces issues like errors and delays, leading to:

- Duplicate payments

- Late payment of fees

- Missing out on early discounts

As a result of these operational inefficiencies, organizations suffer impaired profitability and financial losses.

The two most significant disadvantages of the manual accounts payable process

are:

– Lack of control

– Lack of management visibility

Aside from these, the two other significant obstacles preventing effective decision -making and operational efficiencies are:

- Limited ability to track AP workflows.

- Ability to analyze AP workflows.

As a result, firms run the risk of fraud and noncompliance with financial requirements.

Scalability and Flexibility Issues

With the gradual growth and expansion of any business entity, a variety of requirements emerge that an accounts payable process must support, namely:

- Business expansion,

- Mergers,

- New location setups.

In such cases, traditional manual accounts payable encounter problems in the form of –

- Adaptability

- Flexibility

As a result, the manual accounts payable process becomes more difficult and costly to handle.

Strained Supplier Relationships

The principal causes of strained supplier relationships originate from two key shortcomings in the typical accounts payable process:

- Payments are delayed and inaccurate.

- Communication gaps

This frequently leads to a plethora of challenges springing up in supplier relationship management, including:

- Trust and dependability difficulties

- Suppliers’ payment terms are poor

- Discounts are limited.

As a result, there is a significant impact on the organization’s total supply chain management.

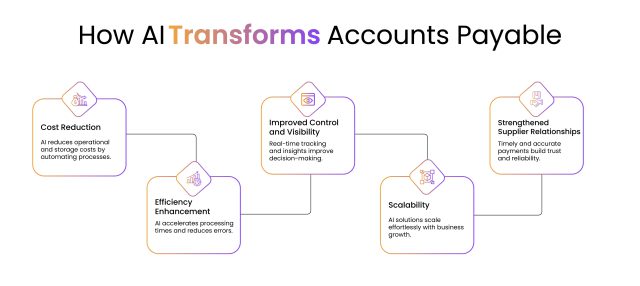

Revolutionizing Accounts Payable with AI: The Power of Intelligent Document

Processing (IDP)

AI revolutionizes manual accounts payable (AP) processes by powering intelligent document processing (IDP). Through AI, document handling is automated, costs are reduced, accuracy is ensured, and efficiency is enhanced. This solution provides real- time tracking, improves control, and scales effortlessly with business growth, leading to stronger supplier relationships.

Reducing Costs and Storage Overheads

Manual accounts payable (AP) processing is often burdened with high operational and storage costs. Intelligent document processing (IDP) streamlines these tasks by automating the handling and storage of paper documents, significantly reducing expenses. By digitizing invoices and related documents, businesses can cut down on physical storage needs, freeing up valuable space and resources.

Enhancing Efficiency and Profitability

Inefficiencies in manual AP processing frequently lead to duplicate payments, late payment fees, and missed early payment discounts, negatively affecting profitability.

IDP ensures accuracy and timeliness, eliminating these costly errors. Automated systems promptly process invoices and payments, maximizing early payment discounts and avoiding late fees, thus enhancing overall efficiency and profitability.

Improving Control and Visibility

A major drawback of manual AP processes is the lack of control and visibility, hindering informed decision making. IDP provides real time tracking and detailed insights into the AP workflow, enabling better management decisions and improved operational efficiency. Enhanced visibility also reduces the risk of fraud and ensures compliance with financial regulations.

Scalability and Flexibility

As businesses grow, manual AP processes become increasingly cumbersome and expensive to manage. IDP scales effortlessly with business expansion, mergers, and new locations, ensuring the AP system remains efficient and cost-effective. This flexibility allows businesses to adapt their AP processes seamlessly to changing needs and complexities.

Strengthening Supplier Relationships

IDP facilitates faster and more accurate payments, improving relationships with suppliers. Timely payments and accurate updates build trust and reliability, fostering stronger business partnerships. Improved supplier relationships can lead to better terms and discounts, enhancing the overall efficiency of the supply chain.

In conclusion, the power of AI helps IDP streamline AP, resulting in the following outcomes:

Accuracy and Profitability

IDP ensures accuracy, eliminates errors, and boosts efficiency and profitability.

Real-time Insights

IDP provides real-time tracking for better decisions and improved efficiency.

Scalability and Relationships

IDP scales seamlessly, fostering stronger relationships through accurate payments.

To experience ‘Intelligent Automation’ transforming accounts payable through the use of intelligent document processing, connect with DocVu.AI at : www.docvu.ai