Introduction:

Borrowers in the mortgage industry face a lengthy mortgage processing time, which often extends from anywhere between 35 and 40 days. The primary reason for such longer time periods required for processing is owing to the requirement of extensive document verifications, regulatory compliance checks, and managing vast volumes of documents and the underlying data.

Traditionally, this process has always been handled manually, lending inefficiencies leading to delays. As a result, mortgage lenders have to incur rising operational costs that eat away at their profit margin, making it harder for them to stay competitive in the fast-evolving mortgage market.

However, with the advent of technologies such as artificial intelligence (AI), robotic process automation (RPA), optical character recognition (OCR), and intelligent document processing (IDP), there has been a rapid shift in the way mortgage lenders have been operating in the mortgage origination space.

No more are there delays and human errors in the mortgage origination process as a result of streamlined workflows with the aid of intelligent automation.

In this blog, we will look into these aspects that challenged the traditional origination process workflows and then highlight how embracing intelligent automation has become imperative for mortgage lenders in bringing in an efficient mortgage origination process.

Challenges:

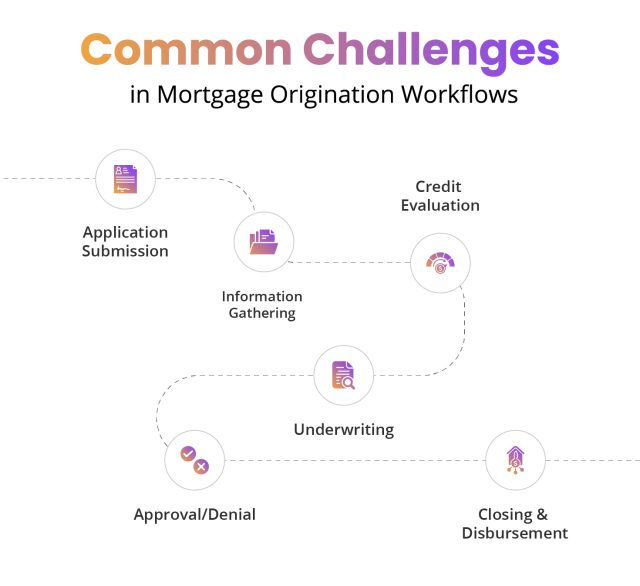

A closer look into the mortgage origination workflows reveals the true magnitude of challenges faced by lenders.

Here are some of them described in detail:

- Application submission stage

This is the initial stage of the mortgage origination process, wherein borrowers sometimes submit incomplete applications consisting of missing information. This leads to inaccurate and incomplete documentation, leading to complicating the process further down the processing funnel. - Information gathering stage

A major issue faced at this stage is the existence of data silos where information is scattered across different systems. This fragmentation creates a bottleneck for lenders in accessing comprehensive borrower profile information. As a result of this, credit evaluation errors are creeping into the system. - Credit evaluation stage

Conventional manual evaluation of borrowers’ credit information is heavily dependent on the individual’s credit history. It creates a ‘credit bureau blind spot’, wherein individuals lacking past credit history are unfairly excluded from loan consideration. This leaves room for improvements in credit evaluation by including more data sets that can help these types of credit deprived individuals obtain mortgages. However, with the increased number and volumes of loan evaluation criteria, a process of manual evaluation might not be the best option. - Underwriting stage

One of the most challenging processing situations faced at this stage is the output obtained from legacy systems and their technologies. It not only prolongs the underwriting process but at times becomes frustrating for both lenders and borrowers alike. - Approval/denial stage Compliance issues complicate the approval process as mortgage lenders need to accommodate the ever changing guidelines. Problems start happening when adapting quickly to such compliance requirements leading to errors and subsequent penalties.

- Closing and disbursement stage

The closing stage of origination throws a cutthroat competitive scenario, wherein slight delays from time-to market issues often lead to loss of business to more agile mortgage players. Such customer retention challenges often cost dearly to lenders in an extremely tight and competitive market like the mortgage industry.

Addressing these challenges holds the key to reducing the turnaround time of mortgage origination, on which we are now going to shed some light in the following section.

Solutions:

Digital transformation of mortgage origination workflows by deploying intelligent automation consists of the use of various cutting edge technologies such as OCR, IDP, RPA, etc. We will describe how the combination of these technologies as a part of intelligent automation enhances mortgage origination workflows in the following section and then take a closer look into the technological aspect of IDP solutions.

A. Enhancing mortgage origination workflows

- By using automated systems, intelligent automation simplifies the initial mortgage application submission process. This enables completeness of the application process by ensuring all necessary documents are uploaded on the loan origination system (LOS), thereby removing the possibilities of delays from incomplete mortgage applications and subsequent follow ups.

- In the next stage, combining optical character recognition (OCR) and natural language processing (NLP), application documents are classified and data is extracted from these various types of documents. It has been observed that using these cutting-edge technologies, intelligent automation can cut almost 80% of document processing time.

- Next in the underwriting phase, analyzing income verification documents and assessing associated risk factors can be performed efficiently using intelligent automation. With the use of artificial intelligence (AI) and machine learning (ML), lenders can extract data and analyze it in a short period of time, leading to faster loan approvals and enhancing customer satisfaction.

- By managing communication and document routing at the closing stage, with intelligent automation, lenders can ensure all parties are informed in real time. This results in further speeding up the overall mortgage processing time, enhancing borrowers’ experience.

B. Harnessing the power of GenAI and OCR with an IDP solution

The three most important aspects of reducing the processing time in mortgage origination are document classification, data extraction, and validation. These steps are prone to errors when performed manually. Therefore, automating these steps not only reduces the processing time but also minimizes errors.

The best available technology to perform intelligent automation for these steps is intelligent document processing (IDP) solutions such as DocVu.AI.

- AI-powered positional OCR of DocVu.AI automatically learns and adapts to different mortgage document formats, including unstructured data formats, eliminating the need for time-consuming template creation.

- By combining positional OCR and regression locator algorithms, DocVu.AI accurately identifies and extracts key data points from mortgage documents, eliminating the need for human intervention.

DocVu.AI’s regression locator algorithm, by precisely locating and extracting information from mortgage documents, enables faster processing, leading to the mortgage origination workflow becoming not only faster but efficient too.

Conclusion:

Intelligent automation is transforming the mortgage sector by significantly lowering the processing time, thereby enhancing the customer experience. Technologies such as OCR, NLP, AI, and ML are enabling lenders to automate critical steps in the mortgage origination process. This leads to various process outcomes such as submitting completed applications, rapidly classifying documents, expediting income verification, etc., to name a few.

By using these technologies through intelligent document processing (IDP) solutions, lenders are experiencing reduced cost, improved customer experiences, and better decision-making, making intelligent automation imperative for staying competitive.

CTA:

Connect with us at: www.docvu.ai