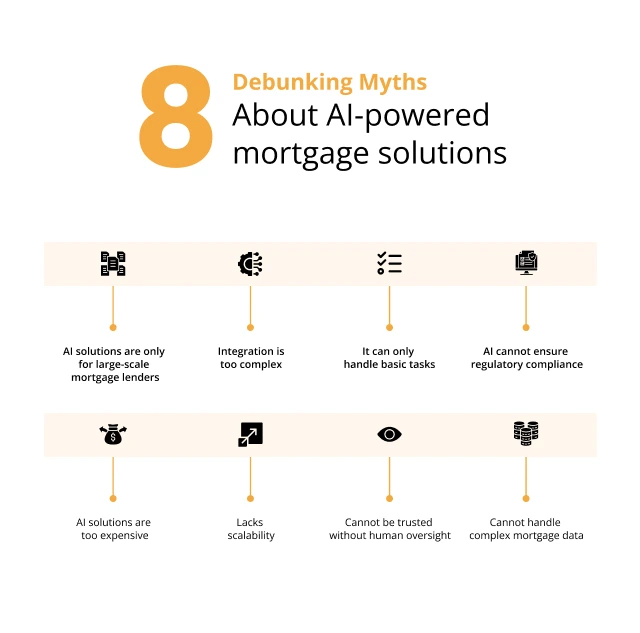

The mortgage sector is renowned for its intricate and exacting procedures, and it is changing quickly in tandem with technology. AI-powered solutions are at the forefront of this change. Misconceptions about these technologies, have led to distrust and discouraged many from using them. This blog dispels eight common misconceptions regarding artificial intelligence (AI) in mortgage administration and reveals the technology’s full potential to revolutionize efficiency, workflows, and compliance.

1. AI solutions are only for large-scale mortgage lenders

Myth: A common belief is that AI-powered solutions cater exclusively to large mortgage lenders due to their perceived cost and complexity. This is far from reality.

Truth: The use of current artificial intelligence systems makes it flexible to accommodate the needs of both small and big lenders. The current cloud-based AI solutions can be deployed with more relaxed price structures, which means that more modest lenders can afford to employ highly complex services without having to invest extensively at their outset. They eliminate repetitive procedures and disclose ways for smaller organizations to become equal to enormous firms through better and cheaper customer service.

2. Integration is too complex

Myth: Many fear that incorporating AI into their existing infrastructure will lead to disruption and downtime, making the transition cumbersome.

Truth: AI-powered platforms prioritize seamless integration. With intuitive interfaces and migration tools, these solutions integrate effortlessly with loan origination systems, CRM tools, and back-office applications. The implementation process is supported by dedicated experts, ensuring minimal disruptions. Once integrated, AI enhances workflows, boosts processing speeds, and fosters operational agility.

3. It can only handle basic tasks

Myth: Some perceive AI as being limited to automating repetitive tasks like data entry, overlooking its potential in managing more sophisticated operations.

Truth: Advanced AI systems excel at handling complex mortgage processes. From analyzing credit reports to extracting and validating data from title documents, these tools leverage machine learning (ML) and natural language processing (NLP) to manage intricate tasks with unparalleled precision. AI also supports predictive analytics, enabling lenders to assess borrower behavior and optimize risk management strategies.

4. AI cannot ensure regulatory compliance

Myth: Many believe that it cannot keep up with the constantly changing compliance rules in the mortgage industry.

Truth: Automation is a powerful ally in regulatory compliance. It automates checks for AML, and other requirements, ensuring that documents meet the latest standards. AI systems continuously learn and adapt to changes in regulations, offering real-time updates to maintain compliance. Additionally, these tools generate detailed audit trails, facilitating transparent reporting and reducing the risk of non-compliance.

5. AI solutions are too expensive

Myth: Cost concerns are a significant barrier for many lenders considering AI adoption, with the perception that only large enterprises can afford such technology.

Truth: They have become more accessible with subscription-based and pay-as-you-go models. These pricing structures allow lenders to adopt AI without significant financial burden. The cost savings generated through improved efficiency, error reduction, and faster processing times often outweigh the initial investment, delivering substantial long-term returns.

6. Lacks scalability

Myth: The notion that AI systems are rigid and unable to accommodate business growth is another misconception.

Truth: It is inherently scalable. Cloud-based platforms handle increasing volumes of data and applications without compromising performance. Whether dealing with seasonal spikes or long-term growth, AI systems expand seamlessly to support business needs, eliminating the need for additional infrastructure or resources.

7. Cannot be trusted without human oversight

Myth: Skeptics argue that AI lacks the nuance and judgment of human decision-making, making it unsuitable for critical processes like mortgage lending.

Truth: AI complements, rather than replaces, human expertise. It automates time-consuming tasks and provides data-driven insights, allowing professionals to focus on nuanced decision-making. This collaboration between AI and human oversight leads to better accuracy, faster processing, and more informed outcomes.

8. Cannot handle complex mortgage data

Myth: It struggles with diverse and intricate mortgage documents, limiting its usability in real-world scenarios.

Truth: It is specifically designed to process complex documents, including loan applications, credit reports, and handwritten forms. Leveraging advanced recognition capabilities, AI ensures accurate data extraction and classification. This versatility streamlines document handling, minimizes errors, and accelerates processing timelines.

Conclusion

Automated solutions are not only time-saving solutions but rather tools with the potential to revolutionize the industry. When the myths surrounding AI are discussed and dispelled it becomes easier to understand how it can transform processes for the better, help businesses adhere to measure regulations, and improve decisions made. AI can assist mortgage lenders, may it be small or big, with their aims geared toward decreasing their cost and boosting efficiency to match the competition. The future of mortgage processing is all about using the right tool that will not only serve the current needs of businesses today but also help survive the uncertainties of tomorrow.