Imagine a financial institution facing millions in regulatory fines not due to fraud or mismanagement, but simply because its recordkeeping system failed to maintain accurate data. In today’s highly regulated environment, this isn’t a rare occurrence; it’s a growing crisis. A recent report by The Economist revealed a 40% surge in regulatory penalties against firms using fragmented recordkeeping systems, with 53% of breaches traced back to human errors in manual data entry. Meanwhile, Bloomberg highlighted that 79% of auditors now flag “inconsistent digital trails” as a major risk in financial reporting.

In such a high-stakes environment, AI-driven platforms like DocVu.AI are transforming financial recordkeeping by automating document processing, ensuring data integrity, and enhancing regulatory compliance. Through intelligent data extraction, automated mortgage lifecycle management, and secure cloud storage, financial institutions can eliminate inefficiencies and build a future-ready recordkeeping system.

The hidden costs of fragmented data ecosystems

For many financial institutions, loan servicers, and insurance providers, managing vast volumes of records is a growing challenge. Disjointed legacy systems, paper-based workflows, and unstructured data storage create silos that lead to inefficiencies, compliance risks, and data retrieval delays.

A study by Harvard Business Review found that companies lose an average of 12% of their annual revenue due to errors and inconsistencies in financial records.

Consider the case of a major U.S. mortgage lender that faced a multi-million-dollar penalty due to discrepancies in its loan documentation. Their records were fragmented across multiple systems and manual data entry errors led to inconsistencies in borrower files. This led to non-compliance with Federal regulations, and despite the lack of fraud, the lender was hit with a significant fine. The incident underscores the hidden costs of fragmented data systems and the urgent need for more efficient, integrated solutions.

How can financial institutions eliminate data silos and improve compliance?

AI-driven solutions, like DocVu.AI, help financial institutions eliminate data silos, improve accuracy, streamline processes, and ensure compliance with a unified recordkeeping system.

- AI-driven document indexing – Automatically classifies and organizes financial records, ensuring fast retrieval and regulatory adherence.

- Self-healing data pipelines – Identifies and corrects inconsistencies in mortgage files, invoices, and financial statements, reducing manual intervention.

- Secure cloud-based storage – Centralized digital repositories prevent data fragmentation and provide role-based access control for security.

From automation to anticipation: AI as a strategic partner

While automation has streamlined document processing, the next evolution lies in predictive AI. Instead of just digitizing financial records, AI can now analyze and anticipate potential risks, helping institutions proactively manage compliance, fraud detection, and operational inefficiencies.

How can AI shift financial recordkeeping from reactive to proactive?

- Behavioral analytics – AI detects irregular transaction patterns, helping institutions flag fraudulent activities before they escalate.

- Intelligent document processing – AI extracts critical financial insights from unstructured data sources, reducing manual verification efforts.

- Regulatory sandboxing – Simulates compliance risks before new policies are implemented, ensuring regulatory readiness.

DocVu.AI: Transforming financial recordkeeping with AI-driven solutions

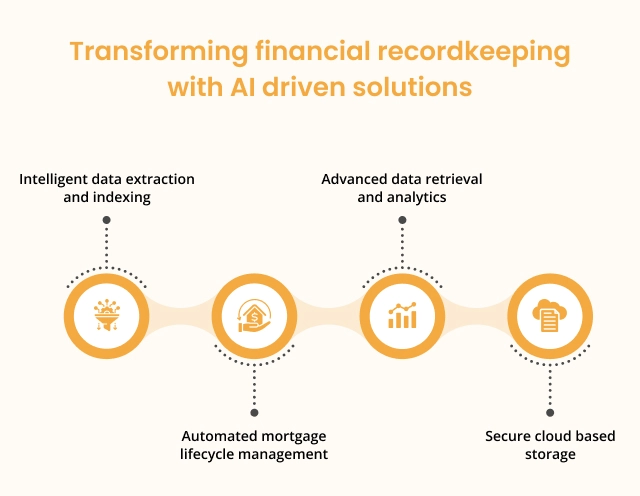

DocVu.AI offers a comprehensive suite of AI-powered solutions designed to streamline financial document management, improve compliance, and optimize operational efficiency.

- Intelligent data extraction and indexing – AI automatically organizes financial documents, enhancing mortgage processing, contract validation, and invoice reconciliation.

- Automated mortgage lifecycle management – From loan origination to servicing, DocVu.AI automates workflows, reducing manual errors and processing time.

- Advanced data retrieval and analytics – AI-powered search and categorization tools provide instant access to critical financial records, eliminating bottlenecks during audits and regulatory reporting.

- Secure cloud-based storage – Encrypted cloud archiving ensures long-term data integrity, role-based access control, and compliance adherence.

Privacy-preserving collaboration in a distributed world

As financial institutions expand globally, secure real-time data sharing becomes crucial. AI-driven privacy-preserving mechanisms, such as federated learning and encrypted collaboration frameworks, allow institutions to analyze and exchange data without exposing sensitive information.

A study by McKinsey found that firms implementing secure AI collaboration models reduced cross-border audit times by 50%, enhancing compliance while maintaining data privacy.

With DocVu.AI’s role-based access controls, AI-powered compliance monitoring, and encrypted cloud storage, financial institutions can ensure data security without compromising efficiency.

How does record digitization drive efficiency and agility in financial operations?

Financial institutions handling vast volumes of loan documents, invoices, and contracts often face delays due to manual processing and scattered data storage. Digitizing records isn’t just about going paperless it’s about unlocking speed, accuracy, and seamless accessibility.

Key advantages of records digitization:

- Faster document retrieval – AI-powered indexing ensures that loan files, mortgage records, and financial statements are instantly searchable, reducing operational lag.

- Enhanced decision-making – Structured digital records provide real-time insights, enabling finance teams to analyze trends and make informed strategic choices.

- Scalability and cost savings -Eliminating paper-based workflows reduces storage costs while enabling institutions to scale operations without bottlenecks.

The urgency of change: Why financial institutions can’t afford to wait

The need for AI-driven financial recordkeeping solutions is more urgent than ever. As regulatory scrutiny increases, the cost of non-compliance continues to rise. Financial institutions that continue to rely on fragmented systems risk facing substantial penalties, operational inefficiencies, and data security breaches.

With businesses losing a significant portion of revenue due to inaccuracies in financial records and regulatory penalties on the rise, the stakes are higher than ever.

Imagine a global insurance provider facing major fines due to missed deadlines for regulatory reporting. Their outdated systems result in inconsistent records and delays in retrieving critical data during audits. This costly mistake could have been avoided with a unified, AI-powered solution like DocVu.AI, which offers real-time access to compliant, up-to-date records.

Conclusion: The time for change is now

The transition toward AI-driven financial recordkeeping is no longer optional it is essential for institutions aiming to enhance compliance, mitigate risks, and improve efficiency. Relying on outdated manual processes and fragmented systems leads to compliance penalties, operational inefficiencies, and security vulnerabilities.

With intelligent data extraction, automated mortgage processing, secure cloud storage, and predictive AI compliance, DocVu.AI is at the forefront of transforming financial recordkeeping.

The future of compliance and efficiency starts with AI-driven transformation is your organization ready?