Automation: Key to Streamlining Mortgage Document Processing in a competitive market

“Things get done only if the data we gather can inform and inspire those in a position to make [a] difference.” – Mike Schmoker, Education Writer, Speaker. Data is the fuel that powers businesses to make informed decisions, but the critical question remains, “Is the data relevant?” For Data to be relevant, enterprises need solutions […]

How to Streamline mortgage Operations with Template-Free Document Processing

“Liberty, when it begins to take root, is a plant of rapid growth.” – George Washington. The same can be said about data these days. Today businesses have to transform with changes in the market dynamically and thus cannot afford to spend time extracting data and insights from unstructured bulk documents. Freedom from manual and […]

DocVu.AI features in Everest Group Intelligent Document Processing Products PEAK Matrix® 2022

DocVu.AI has achieved a notable accomplishment of featuring in the Everest Group’s IDP PEAK Matrix® Assessment as 1 of 5 Aspirants for 2022. Challenging the industry standards for speed and accuracy in data extraction and indexing by leveraging the power of true AI/ML, DocVu.AI’s vision and capabilities have set it to move further in the […]

Document Automation and the Future of Non-QM Loans with IDP solutions

As margins thin out, lenders are faced with the task of reconfiguring their existing cost structures while looking for alternate revenue streams. The non-QM market is emerging as a lucrative and practical solution for many. COVID-19 halted the boom of non-QM due to the liquidity constraint, however, it regained its market share and finished 2021 […]

Make data-driven decisions using DocVu.AI to improve business efficiency

In Q2FY2021, 16% of mortgage banks reported a pre-tax loss. The primary factors for that were the high cost of operations and a plateau in revenues. For the last four quarters, the mortgage industry has seen healthy growth in revenues. US mortgage banks have adopted strategies to capture mortgage demand. As revenue growth for the […]

How banks can protect mortgage margins and increase ROI

Net gains in 2021 Q4 declined to $1,099 on each loan originated, compared to $2,594 in the previous quarter, according to a report published by the Mortgage Bankers Association (MBA) on Thursday. This slide-in profitability is on a 6 quarter trend. This is due to softening demand resulting in the slide in the volume of loans. With the […]

Why you should automate fraud detection in insurance claims processing

Insurance we have a problem – Fraud detection 18 percent of all claims in insurance are fraud. 40 percent of insurers polled said their technology budgets for 2019 will be larger, with predictive modeling and link or social network analysis the two most likely types of programs considered for investment. About 90 percent of respondents […]

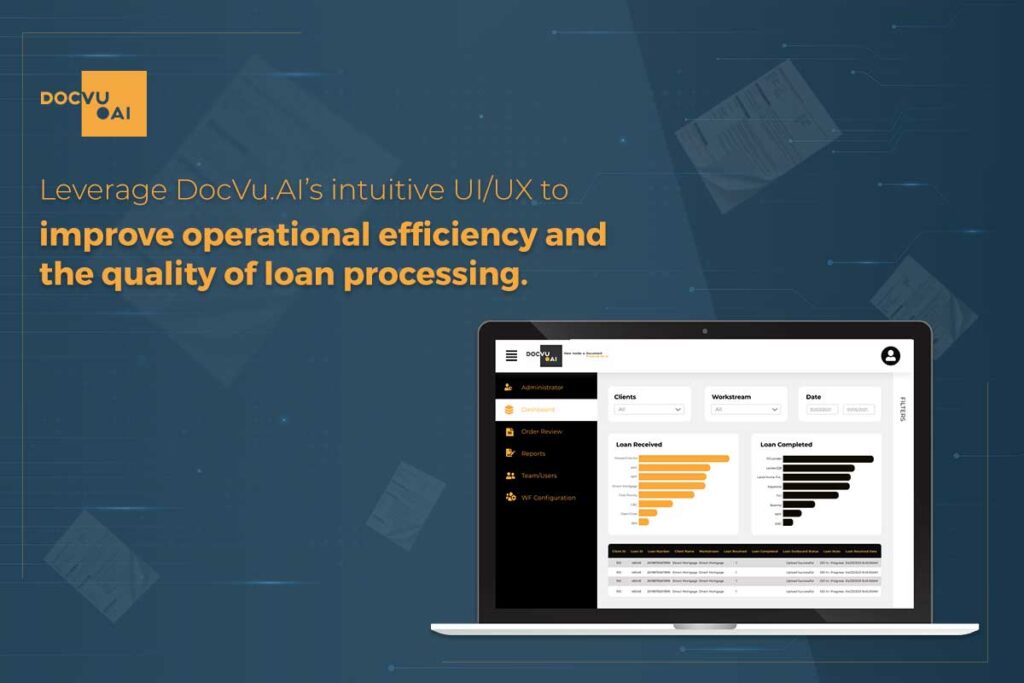

How to Improve Mortgage Origination Efficiency using DocVu.AI’s Intuitive UI/UX

Quality user experience through intuitive UI/UX has become vital in today’s full-scale digital ecosystem. Document processing solutions in the mortgage industry need to create more streamlined workflows and intelligent indicators to make mortgage processing more seamless to help cut down on the average number of days it takes to process the loans. The enhanced user […]

Improve Efficiency in document processing: Reduce Cost through Noise Elimination

According to a recent McKinsey report, automating document processing with IDP has the potential to save organizations up to 90% in operational costs. IDP solutions provide greater accuracy through advanced machine technologies built over deep human expertise. With consistently better accuracies through an IDP solution, a mortgage lender can utilize the manpower for more important […]

The benefits of Digitizing Mortgage Operations with Centralized Document Library

Complex, paper-based, and error-prone, the management of mortgage documents is often troublesome exposing financial institutions to the potential for unnecessary inefficiencies, losses and defaults. DocVu.AI serves as a central document library and provides a 360 degree view of mortgage documents across the organization. The dynamic forms for all application documents and collaterals type are customizable […]