Introduction to Invoice Matching in Accounts Payable

Invoice matching is a vital process in accounts payable that maintains correct and timely vendor payments. When it comes to invoice matching, there are three types: two-way, three-way, and four-way.

Looking deeper into each of them we find that the ‘Two-Way Invoice Matching’ is the

easiest way, which involves the accounts payable team checking vendor’s invoices against the original purchase order. This helps to confirm invoice accuracy and prevents

overpayments.

Next comes ‘Three-way matching’; which extends this process to compare the invoice with a goods receipt or service confirmation. This ensures that the company is billed only for goods and services that were both received, as well as accepted.

Finally comes the best method which is ‘Four-way invoice matching. Under this, aside from the purchase order and goods or service verification, the AP team also analyzes invoices to contract /service agreements. The last step makes sure that the payment sticks to what is told.

In this blog, we look into each of these above-mentioned invoice matching procedures and then delve deeper into them for a better understanding of how their appropriate implementation can affect the overall performance and efficiency of your accounts and finance department.

What is invoice matching?

Invoice processing is a key accounts and finance department process managed by the accounts payable team. It starts with the initial receipt of the invoices from the vendor/supplier till the final payment is made and involves managing the entire lifecycle of these vendor/supplier invoices.

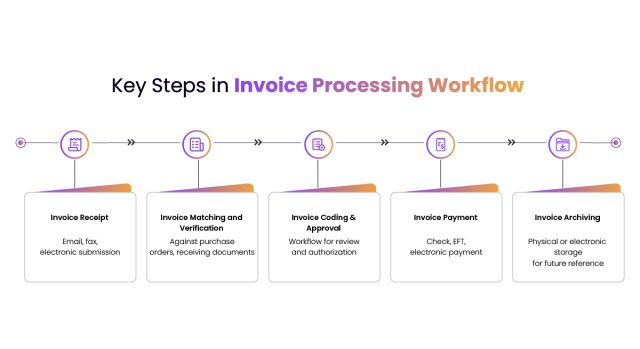

Let us look a bit closely into the key steps in the invoice processing workflow:

– Invoice Receipt: After a purchase is made, invoices are received from vendors/suppliers through either email, fax, or electronic invoice submission procedure. Once an invoice is received, the accounts payable team needs to capture the invoice data about vendor details, invoice date, invoice number, description, amount due, and so on.

– Invoice Matching and Verification: The invoice details are matched against purchase orders, receiving documents, and other supporting documents to verify accuracy and legitimacy. All differences between the invoice and supporting documentation should be resolved before processing.

– Invoicing Coding & Approval: The invoice is coded with the appropriate general ledger account, cost center, and any other accounting information that you should provide to get reimbursed. The document is then forwarded through an approval workflow for review by a person who has the authority to approve the request and trigger its payment.

– Invoice Payment: Once approved, the invoice is scheduled for payment based on the vendor’s payment terms. Usually, payments are made and accepted via check, electronic fund transfer (EFT), or other electronic payment types.

– Invoice Archiving: After payment, the invoice and associated documentation are archived, either physically or electronically, for record-keeping and audit purposes.

Need of invoice matching

Vendor invoice management and tracking are necessary for the company to handle

vendors’ invoices and keep correct records. Below are the key facts on why the processing of invoices is of significance.

- Payment accuracy: Properly planned and implemented invoice processing facilitates decreases in the possibilities of overpayments, underpayments, delayed payments or even making payments to the wrong payee. Make sure that the companies’ invoices are received, approved, and paid for correctly.

- Improve vendor relations: Timely and efficient processing of invoices is known to enhance the relationship between a business and its vendors/suppliers. This helps the suppliers understand that your business is creditworthy and will pay promptly.

- Cash management: The features of working with invoice software include the real-time tracking of the amount of money owed, the amount of money due, the orders, etc. This makes it possible to monitor cash flow in a better and consecutively more predictable manner.

- Streamlined workflow: Most importantly, automated invoice processing does not require input of data manually by the personnel, hence eliminating the chances of making mistakes and at the same time, is much faster. It releases account-paying employees; they are now less bogged down with other activities that are not related to strategy making.

- Compliance mechanisms and accounting mechanisms: A proper invoicing system is both logical and easier to follow every financial transaction that is made, while at the same time paving the way for a clear way of ensuring that every financial transaction is made following the set accounting standards and recognized tax laws.

Here are the various types of invoice-matching

Accounts payable automation uses three forms of matching: two-way, three-way, and four-

way.

– Two-way invoice matching: This happens when a third-party invoice is matched with a purchase order, tolerances are met, and the invoice is saved in a database.

– Three-way invoice match: This occurs when an invoice is matched with a purchase order, a receipt for goods, and a supplier invoice. All three components must be within agreed- upon tolerances. The information is subsequently entered into the AP system.

– Four-way Invoice Matching: This technique, like three-way matching, requires a purchase order, a receipt for items, and a supplier invoice. Additionally, inspection information is also required to make it a four-way system.

Tolerances and Holds in Invoice Processing

The tolerance and holds are used in efficient invoice processing to produce an accurate and compliant end product. Let us now explain their mechanisms and role in financial activities.

The Role of Tolerances

Tolerances are set values that confirm if the invoice amount is correct or not regarding the

PO details. This step can be done to ensure that there are no disparities in the information given or to keep things organized. Hence, when an invoice meets these tolerances, it is a sign that the transaction details correspond with the PO.

Managing Invoice Holds

An invoice hold is raised in circumstances where there is a failure to match the PO with the invoice or goods cannot be validated to have been received. They protect instances whereby one has provided his/her money to pay for goods or services that have not been recorded or delivered.

Types of Deviations

– Quantity Deviation: This takes place when the quantity stated on the invoice differs from the quantity stated on the purchase order and or the received goods. It is useful in avoiding the consistency of charging more than is required or the receipt of less than is due.

– Price Deviation: This may occur when the price that has been arrived at during the purchase order is different from the price on the invoice. Price variations prevent fleecing of the consumer by charging high amounts or on the other extreme, charging very low amounts.

The Software and Company Policy factors:

The ability to manage tolerances and holds mainly depends on the specific software employed and corporate standards. Thus, while doing the approval, there may be a certain level of flexibility for faster decision making about certain discrepancies. Nevertheless, all invoices might not adhere to planned and specified tolerances for data review. That is if an invoice is not processed to these criteria, its payment will be suspended till when it is corrected or released through an exceptions list.

To sum up, the need for the proper control of constant tolerance checks and handling of invoices plays a large part in the accurate calculation of the financial data and reduces occurrences of possible disruptions.

The importance of Two-way / Three-way & Four-way Invoice matching

Ensuring Accurate Billing using two-way, three-way, and four-way invoice matching and

their importance

– Accurate Billing Verification

Two-way, Three-way, and Four-way match, in the case of AP, ensures that firms are being billed the correct price for the quantity ordered according to their contract. These methods check the order, receipt, and invoice to avoid overcharging and identity mismatches.

– Protection Against Errors

When specifying the match, if vendors have sent more or supplied at a cheaper price, this will not be a problem. But only if they have sent less or charged more than they had agreed upon, then a discrepancy occurs. This process of checking the errors transfers the responsibility to the vendor regarding the agreed terms which are very easy to ascertain when it comes to delivery-based manufacturing.

What is manual invoice matching?

The traditional AP method of matching invoices means that a member of the accounts payable team looks for documents relevant to an invoice for comparison and checks the consistency of every figure in the documents and the invoice. Ideally, it may take days to complete this process, more so when the invoices received are many.

Many organizations still employ traditional methods of invoice processing manually, despite the availability of technologies to perform the same.

While it may seem quite convenient and straightforward to process invoices, in reality, it is time consuming and prone to errors, leading to inefficiency.

Let us look into these detriments of manual matching of invoices more closely:

- Manual data entry of invoice details: One of the biggest drawbacks of manual invoice processing is the manual data entry of invoice details. This is not only a lengthy and time- consuming process, but also human errors in recording correct data can lead to financial discrepancies, leading to losses and strained supplier relations.

- Challenges of tracking duplicate invoices: In the case of vendors sending duplicate invoices with the same or different invoice numbers and details, it becomes difficult to track them when invoice processing is done manually. This situation gets aggravated at times of partial payments or corrected invoices. Without a systematic process of automatically tracking such duplications, there is every possibility of confusion leading to payment issues.

- Manual exception management challenges: When invoice processing discrepancies occur, manual exception management becomes challenging. During such times, accounts payable team members have to physically verify multiple documents from different departments and obtain the necessary authorization before invoices are processed. This leads to a longer billing cycle, resulting in payment delays and vendor relationship issues.

Moreover, during financial audits, these discrepancies tend to be serious issues due to the lack of a proper formal invoice tracking mechanism. - Process visibility challenges due to a lack of transparency: In manual invoice processing, often it is difficult to ascertain the processing status of different invoices or find out which invoices are cleared for payments, which invoices are approaching payment deadlines, and which invoices are stuck up in the processing workflow due to some issues. This aspect of lack of visibility puts added pressure on the accounts payable team while prioritizing tasks in the face of missed deadlines.

What is automated invoice matching?

It is possible to automate the integration of invoice matching processes into a digital AP automation solution and create a touchless AP system. Today’s AP solutions have an intelligent matching engine based on machine learning and artificial intelligence, addressing all those tasks and helping the accounts payable team to save time.

Introduction to AI for automating the process of Invoice Matching

AI applied to automate invoice matching involves using algorithms to match data that is entered on an invoice to the records of a company. Automated tools like machine learning algorithms help in analyzing two sets of data and comparing them for anomalies.

How Does it Work: Understanding the Functioning of AI Automated Invoice Matching?

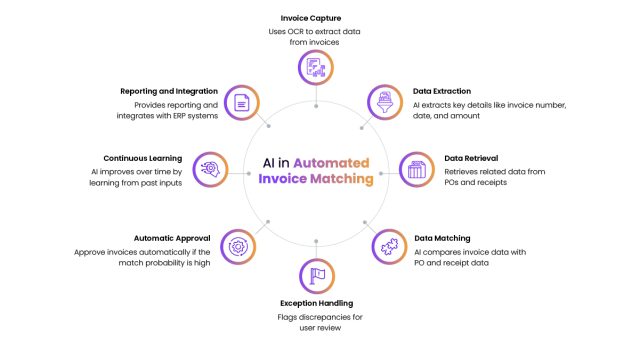

AI and machine learning algorithms allow for invoice matching by automating a process that involves comparing invoices, POs, and receipts. Here’s a step by-step breakdown:

- Invoice Capture: This is followed by the recognition of the data found on the invoices through the use of OCR technology that extracts printed or handwritten text and translates it into data.

- Data Extraction: Invoices are parsed to extract invoice no., date, supplier name, items, and amounts by AI algorithms. These machine learning models are also developed to extract data from different formats for the invoices.

- Data Retrieval: It acquires linked data of purchase orders and receipt records including the PO numbers, quantity, and price.

- Data Matching: AI powered algorithms check for similarities or gaps based on a comparison of PO/receipt data and invoice data. Additionally, It also allows one to specify whether one wants tight or lax matching rules.

- Exception Handling: Whenever the system identifies data anomalies it informs the related stakeholders and users to review and resolve the issues by following a predefined workflow that also includes timely notifications and escalation for speedy redressal.

- Automatic Approval: When the probability of a match is high, the system can approve the invoices for payments without a lot of intervention hence being able to fasten the payment process.

- Continuous Learning: In the long run, it becomes more effective since it contains features that make it progressively more competent at understanding the users’ input and previous experience.

- Reporting and Integration: Automated invoice matching systems implemented with the use of advanced technologies such as AI provide strong capabilities of reporting and analytics that enable identifying the degree of matching accuracy as well as revealing possible exceptions. They can also work with most of the accounting and ERP applications for billing and updating changes that will lead to payments.

In conclusion, AI-automated invoice matching applies the concept of machine learning and other developed rules to check the compatibility of data from invoices, POs, and receipts, thereby improving the efficiency of matching.

Making use of Automated Invoice Matching:

As we can see in the contemporary business environment costs have become critical in running an organization and therefore its operations have to be efficient and accurate. Automating preparation and reconciliation of the invoices is an essential tool within these processes.

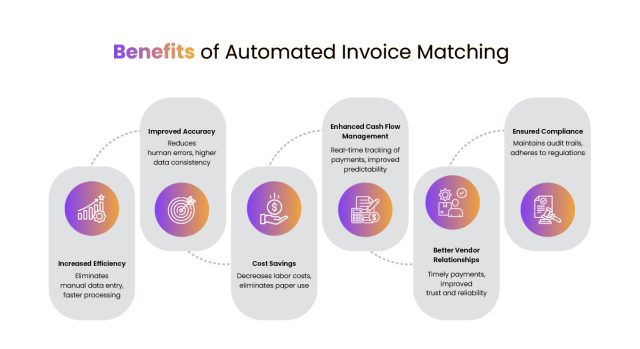

Here’s an overview of the significant benefits automated invoice matching brings to organizations:

– Eliminate Paperwork and Other Time-Consuming Procedures: The first and probably one of the most significant benefits that businesses can gain from the automation of invoices is the elimination of manual data rekeying. The typical task in invoice management is manual data entry, which is rather long and accompanied by a high risk of mistakes. Thus, the automation of this process is very beneficial for finance teams – they can have free time, which is spent on repetitive tasks, and pour it into improved business development and the achievement of strategic goals.

– Submits Faster Approvals: It helps to dispose of invoices much faster due to the option of automatic invoice approvals. This technology ensures the avoidance of many possible errors and guarantees smoot cooperation between different systems, thus making the approvals of invoices fast. Thus, approvals made in less time promote sound financial management, and in particular, assist in providing a continuous cash flow.

– Improves Workflows: The manual AP processes are always characterized by chaos in terms of time consumption and possible mistakes. Automation helps to avoid such restrictions because it optimizes the processing of invoices. Automated systems help to reduce the time and resources spent on corrections for errors made by people, thus improving the financial operation processes.

– Prompt Payments: The approved invoices are automatically put through for payments on time through the process of automated invoice matching. This plays a vital role in sustaining good relationships with vendors and suppliers. This way, payments that are made on time and are accurate assist in the creation of trust and reliability to foster long-lasting business relationships.

– Augment Cash Management: Managing cash is one of the critical activities of any organization, and automation is an essential issue here. Reducing overall delays as well as other penalty charges that are usually accompanied with the original amount to be paid, go a long way in cutting down the overall expenses incurred by an organization, affecting cash flows. This helps to minimize the likelihood of a business facing a cash crunch when they least expect it.

– Ensure Compliance: As with any organization engaged in business operations, regulation and audit requirements are one of the most important components of financial management. The automated systems for invoice processing keep records and provide a fully tracked audit trail where all operations correspond to compliance requirements. They reduce the chances of getting to the wrong side of the law or finding yourself answerable in a court of law.

Conclusion

In conclusion, automatic matching of invoices is not only an evolution in tools but it is a valuable evolution in an organization’s system approach to its finances. Deloitte UK has also echoed the same saying that by adopting automation In the business world, B pains achieve increased efficiency of working, accuracy as well and compliance, all of which act as promoters of growth as well as sustainability.