Mortgage document processing has traditionally been a slow, labor-intensive task for lenders. From verifying borrower details to ensuring compliance with industry regulations, manual document handling consumes valuable time and resources. But with the rise of Artificial Intelligence (AI), mortgage lenders can now streamline their processes, increase accuracy, and reduce overhead costs. DocVu.AI is transforming how lenders handle paperwork, making it faster, more efficient, and cost-effective.

In this blog, we will explore the role of AI in mortgage document processing, the types of documents it can automate, its benefits, and how DocVu.AI can help you start automating your processes.

What is AI Mortgage Document Processing?

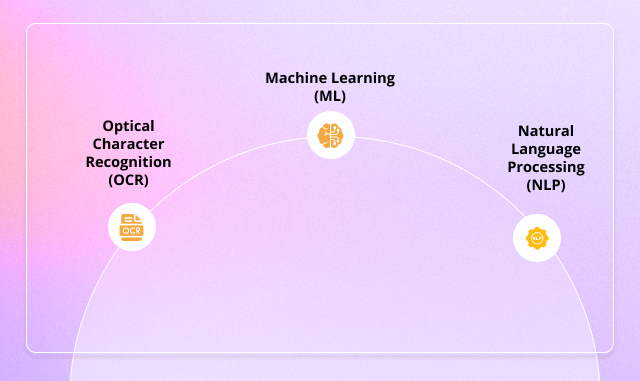

AI mortgage document processing refers to using artificial intelligence technologies such as Optical Character Recognition (OCR), machine learning, and natural language processing to automate the extraction, verification, and management of documents within the mortgage lending process.

DocVu.AI leverages these AI technologies to automate extracting critical data from mortgage-related documents, allowing lenders to quickly and accurately process loan applications, bank statements, tax returns, and more. This automation reduces the reliance on manual data entry, speeds up processing times, and minimizes human error.

Key Technologies in DocVu.AI Mortgage Document Processing

- Optical Character Recognition (OCR): Converts scanned or handwritten documents into machine-readable text.

- Machine Learning (ML): Improves data accuracy over time by learning from historical data patterns.

- Natural Language Processing (NLP): Enables DocVu.AI to understand and interpret text, extracting contextual meaning from mortgage-related documents.

Types of Documents Automated by DocVu.AI in Mortgage Lending

DocVu.AI automates the processing of a variety of documents used in the mortgage lending process, helping lenders save time and reduce the risk of human error. Here are some of the key documents DocVu.AI handles:

- Loan Applications and Forms

DocVu.AI can process loan applications by extracting borrower information and validating it against other documents in the system, ensuring accurate data extraction. - Bank Statements

Using AI, DocVu.AI automatically reads and extracts transaction history, account balances, and other financial data from bank statements, enabling quick verification for loan approval. - Pay Stubs and Income Verification

DocVu.AI scans pay stubs to extract essential employment and income details, which helps accelerate the underwriting process by eliminating manual checks. - Tax Returns

Tax documents are vital for income verification, and DocVu.AI ensures accurate extraction of data from tax forms, reducing manual errors and speeding up the approval process. - Property Appraisals

DocVu.AI can automatically extract relevant details from property appraisals, such as the property’s value and condition, to help lenders make informed decisions. - Closing Documents

Once a loan is approved, DocVu.AI helps automate the extraction of key details from closing documents, minimizing the risk of errors during the final approval stages.

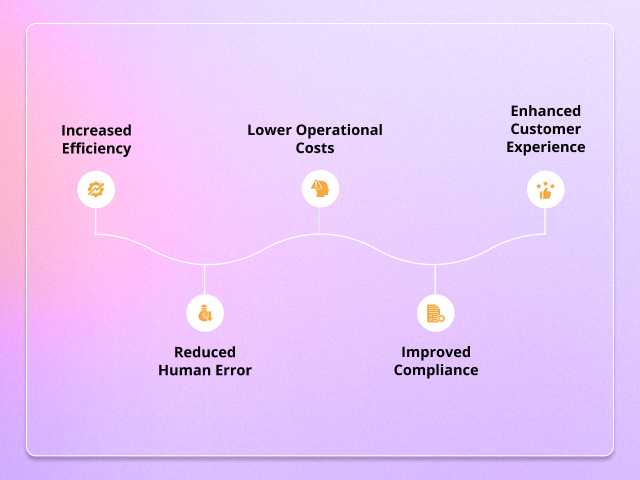

Benefits of Automated Mortgage Document Data Extraction with DocVu.AI

Automating document data extraction with DocVu.AI brings a variety of benefits that make mortgage lending more efficient, accurate, and scalable.

- Increased Efficiency

By automating document processing, DocVu.AI helps lenders speed up the mortgage application and approval process. With AI, large volumes of documents are processed in minutes, reducing processing times from days to hours. - Reduced Human Error

Manual data entry is prone to errors, but DocVu.AI ensures highly accurate extraction of data. This leads to fewer mistakes and greater consistency across documents. - Lower Operational Costs

Automation reduces the need for extensive manual labor, resulting in significant cost savings. With DocVu.AI, lenders can automate tasks that would normally require a large team of employees. - Improved Compliance

DocVu.AI is designed to follow regulatory guidelines, ensuring that all documents are processed in compliance with industry standards and regulations, reducing the risk of compliance issues. - Enhanced Customer Experience

By speeding up the document processing and loan approval process, DocVu.AI enables lenders to offer a faster, more efficient service, improving the overall customer experience.

How to Automate Mortgage Document Processing with DocVu.AI

To automate mortgage document processing with DocVu.AI, follow these simple steps:

Step 1: Assess Your Current Document Workflow

Evaluate your current document management and processing workflows to identify areas that can benefit from automation.

Step 2: Choose DocVu.AI

Select DocVu.AI, a comprehensive AI-powered solution designed to automate the extraction and management of mortgage documents. DocVu.AI integrates seamlessly with your existing document management systems, offering a smooth workflow transition.

Step 3: Train the AI System

DocVu.AI improves its processing accuracy over time by learning from large sets of mortgage-related documents. Begin by training the system with your existing data for optimal performance.

Step 4: Integrate DocVu.AI into Your System

Once DocVu.AI is trained, integrate it into your document management system. This ensures that documents are automatically routed to the right workflows, reducing manual intervention.

Step 5: Monitor and Optimize

Regularly monitor DocVu.AI’s performance and optimize its capabilities. As the AI learns and improves, it will continue to process mortgage documents more efficiently, delivering better results over time.

Industries and Business Sectors Benefiting from DocVu.AI Solutions

DocVu.AI’s intelligent document processing solutions are designed to address the unique needs of various industries, transforming workflows and enhancing accuracy across document-intensive sectors.

1.Finance and Accounts

DocVu.AI streamlines financial document processing by automating data extraction, validation, and analysis. This enables faster, more accurate handling of invoices, tax documents, and financial statements, saving time and reducing errors.

- Accounts Payable and Receivable Automation: Accelerates invoice processing, reconciliation, and payment approvals.

- Compliance Management: Ensures that all financial records meet regulatory standards with built-in validation checks.

- Data-Driven Insights: Provides actionable insights for budgeting, forecasting, and performance analysis.

2. Mortgage Lending

In mortgage lending, where document handling is complex and compliance is essential, DocVu.AI helps streamline operations by automating document review, data entry, and verification processes.

- Loan Application Processing: Speeds up data extraction from applications and supporting documents.

- Document Verification: Automatically cross-checks data for compliance, reducing processing time and improving accuracy.

- Enhanced Customer Experience: Quicker approvals and reduced delays lead to a smoother experience for borrowers.

3. Banking and Finance

DocVu.AI’s solutions bring efficiency to banking by managing large volumes of documents, such as loan applications, customer onboarding paperwork, and transaction records.

- Customer Onboarding: Speeds up the account opening process by verifying documents in real-time.

- Risk and Compliance Monitoring: Automates audit and compliance tasks, ensuring all records align with financial regulations.

- Operational Efficiency: Reduces manual tasks in back-office operations, freeing up resources for high-value activities.

Each of these sectors benefits from DocVu.AI’s robust document automation capabilities, enabling businesses to increase productivity, reduce costs, and maintain high accuracy in critical document processes.

Mortgage Document Processing: Increase Efficiency and Profitability with Automation

Automating mortgage document processing with DocVu.AI helps lenders streamline their operations, reduce costs, and improve document accuracy. By leveraging AI, lenders can accelerate loan approval timelines, improve compliance, and enhance the customer experience.

With DocVu.AI, mortgage lenders can stay ahead of the competition, automate repetitive tasks, and ensure profitable operations with reduced risk and enhanced productivity.

Why Use Automation for Mortgage Loan Processing?

Manual mortgage loan processing can be complex, time-consuming, and prone to errors. The sheer volume of documents, along with the need for accuracy and regulatory compliance, makes it a prime candidate for automation. By implementing DocVu.AI for mortgage loan processing, lenders can:

- Speed up approval times, allowing faster loan closings.

- Enhance data accuracy, eliminating human error.

- Ensure regulatory compliance, meeting industry standards without manual intervention.

- Cut operational costs, reducing the need for large manual teams.

By leveraging DocVu.AI’s powerful AI tools, mortgage lenders can automate their document management and improve their business operations.

Conclusion

AI mortgage document processing is revolutionizing the mortgage lending industry. By automating the extraction and verification of critical data from mortgage-related documents, DocVu.AI offers lenders the tools they need to reduce costs, enhance operational efficiency, and improve customer satisfaction.

Ready to see how DocVu.AI can transform your mortgage document processing? Request a demo or sign up for a free trial of DocVu.AI to experience the future of document management automation.