Introduction:

A 2022 industry report from the Mortgage Bankers Association highlighted that over 60% of companies faced operational errors due to manual loan processing. The loan underwriting process, in particular, can be especially time-consuming and error-prone for mortgage lenders. With manual operations, underwriters must sift through large volumes of documents, verify financial data, and assess risk—all of which increase the likelihood of mistakes and delays. In this blog, we will explore how automation is transforming loan underwriting, reducing these challenges, and improving the overall mortgage process.

Is automation the future of loan underwriting?

Automation is becoming the future of loan underwriting as lenders look for ways to manage growing complexities in the mortgage industry. Traditional underwriting methods, which rely heavily on manual processes, are increasingly seen as inefficient and prone to errors. Automation simplifies tasks like data extraction and document verification, allowing underwriters to focus on more critical decisions. While human oversight remains important, the shift toward automation is inevitable, offering a more efficient way to manage underwriting and adapt to the industry’s evolving demands.

- Shifting industry standards: Automation is setting new benchmarks for how loans are processed, pushing the industry toward more streamlined operations.

- Risk management: Automated systems can identify potential risks faster, providing a more thorough analysis for decision-making.

- Increased focus on complex decisions: With automation handling routine tasks, underwriters can dedicate more time to evaluating complex cases.

- Meeting regulatory requirements: Automation ensures that compliance with ever-changing regulations is maintained more consistently.

Hometrust Bank saves 8,500 hours on loan processing with automated underwriting

Hometrust, a North Carolina-based bank, was facing inefficiencies due to the manual nature of their mortgage underwriting process, particularly in tasks like income calculations and document handling. These tasks were labor-intensive, leading to slower loan processing and increased chances of human error. To solve these issues, Hometrust integrated an AI-powered document automation system into their workflow.

Hometrust saved approximately 8,500 hours annually in document processing and underwriting tasks. This automation allowed their team to focus on higher-value activities, such as evaluating more complex cases and building stronger borrower relationships. Additionally, the bank saw a cost reduction of $90,000.

Can automation offer a sustainable solution?

The traditional manual approach to loan underwriting not only incurs direct labor costs but also contributes to operational inefficiencies that may not be immediately apparent. With increasing loan volumes and complex borrower profiles, many lenders find it challenging to maintain accuracy and compliance while managing their workloads. The ripple effects of these inefficiencies, including missed opportunities and delayed responses, can affect lender competitiveness in a highly dynamic market. By introducing automation, tasks such as document verification, data analysis, and compliance management are handled more effectively, allowing underwriters to focus on more nuanced and strategic decision-making. Automation doesn’t just speed up the process—it creates a more scalable, adaptable system that evolves alongside the ever-changing demands of the lending industry.

- Operational flexibility: Automation allows lenders to manage higher volumes without the need for significant workforce expansion, making it easier to scale operations.

- Consistent data analysis: Automated systems can process and analyze data in a standardized manner, reducing the variability and inconsistency that often occur in manual reviews.

- Risk mitigation: Automation reduces the potential for errors that may lead to compliance violations, improving risk management and protecting lenders from costly fines or reputational damage.

- Strategic resource allocation: With repetitive tasks handled by automated systems, lenders can allocate more time and resources to high-impact areas, such as risk evaluation and client engagement.

How can automation detect and prevent potential data breaches early?

Automation has become a critical ally in preventing data breaches, especially in complex industries like financial services. In 2019, Capital One came across a big challenge. A simple misconfiguration in the bank’s cloud infrastructure allowed a hacker to quietly collect sensitive customer data for four months. During that time, over 106 million records were exposed before the anomaly was finally caught by Capital One’s automated monitoring system. The breach was a wake-up call, illustrating how manual security checks alone fall short in today’s digital landscape. Automation isn’t just an upgrade, it’s a necessity, offering constant vigilance and the ability to respond rapidly to emerging threats. (Sources: Mortgage professional and Massachusetts Institute of Technology)

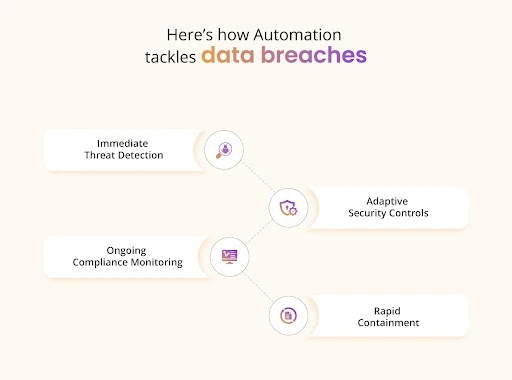

Here’s how automation tackles data breaches

- Immediate threat detection: Automated systems monitor data access 24/7, identifying unusual patterns and sending real-time alerts before a breach becomes significant.

- Adaptive security controls: Automation dynamically restricts access based on user behavior, blocking unauthorized attempts quickly.

- Ongoing compliance monitoring: Regular automated audits identify vulnerabilities, ensuring regulatory compliance and reducing breach risks.

- Rapid containment: In case of a breach, automated protocols quickly isolate compromised areas, protecting sensitive data and enabling faster recovery.

Capital One’s breach serves as a vivid reminder of how automation can transform data security from reactive to proactive, making it indispensable for preventing similar incidents in the future.

Let’s get some insights on how AI can prevent these data breaches

AI has become instrumental in preventing data breaches through a comprehensive, proactive approach. By analyzing vast amounts of data, AI identifies and flags unusual patterns, often catching potential threats before they escalate. It ensures that sensitive information is well-guarded by automating access controls, monitoring user behavior, and quickly responding to anomalies. AI systems also excel at extracting, processing, and securing complex data from documents, improving security across all digital channels. This multi-layered security approach significantly reduces the likelihood of breaches, enabling real-time threat detection and mitigation.

Technologies used by AI to prevent data breaches:

- Machine learning (ML) for anomaly detection: ML models analyze vast datasets to detect unusual patterns and behaviors that may signal potential threats, enabling proactive breach prevention.

- Data indexing and extraction: AI-powered tools rapidly organize and extract structured or unstructured data, identifying and securing sensitive information to prevent unauthorized access.

- Intelligent character recognition (ICR): ICR is an advanced version of Optical Character Recognition (OCR), capable of extracting handwritten or unstructured text from scanned documents, helping identify threats hidden within these files.

- Document management systems (DMS): AI-integrated DMS automates document categorization and monitors access, flagging unauthorized attempts and enhancing security across all stored documents.

- Natural language processing (NLP): NLP analyzes communication patterns to detect phishing or other fraudulent messages, identifying language anomalies that may signal a security threat.

- Zero-trust architecture (ZTA): ZTA enforces continuous verification of users and devices, ensuring access is granted only after real-time validation, making it harder for unauthorized entities to breach systems.

Conclusion

The integration of AI into loan underwriting is not just transforming operational efficiency but also fortifying data security. Automation’s real-time monitoring capabilities, advanced threat detection, and proactive response measures have reshaped how mortgage lenders manage data. As seen in both real-world use cases and advanced AI technologies, a proactive security approach is no longer optional but it’s a necessity. By adopting AI-driven tools like ML, ICR, DMS, and ZTA, financial institutions can minimize risks, enhance compliance, and deliver faster, more reliable services to borrowers. While challenges remain, the continuous evolution of AI tools promises an even more secure and resilient lending environment. As the industry moves forward, embracing AI isn’t just about efficiency; it’s about ensuring a safer, smarter mortgage process for all stakeholders.