Income and property fraud are significant challenges facing the mortgage industry, leading to financial losses and regulatory issues. Fraudulent activities such as falsifying income documents or inflating property values not only harm lenders but also impact the stability of the housing market. In this context, the integration of ‘Artificial Intelligence’ (AI) technologies presents a promising solution to mitigate these risks and enhance security measures.

The Problem

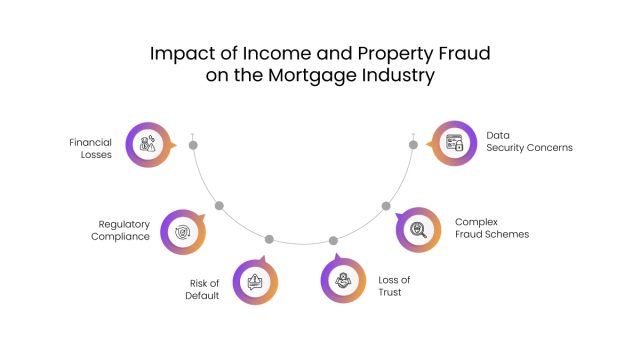

Income and property fraud significantly affect the mortgage industry, causing numerous

challenges. Financial losses directly impact profitability and undermine investor confidence. Non-compliance with regulations due to fraud can result in hefty penalties. There’s also a heightened risk of borrower default and loan delinquencies, further straining financial stability. Trust among stakeholders erodes as fraud becomes more prevalent, and detecting sophisticated fraud schemes adds complexity to the industry. Additionally, the manipulation and exploitation of sensitive borrower information pose severe data security risks. To combat these issues, robust fraud prevention measures and advanced technologies are essential to maintain the mortgage market’s integrity and stability.

Challenges Faced by the Mortgage Industry from Income and Property Fraud:

Financial Losses:

Fraudulent activities such as falsifying income documents or inflating property values can result in significant financial losses for mortgage lenders. These losses impact profitability, investor confidence, and overall market stability.

Regulatory Compliance:

Mortgage lenders must adhere to strict regulatory guidelines and compliance standards. Income and property fraud can lead to regulatory penalties and legal consequences if not detected and addressed promptly.

Risk of Default:

Loans based on fraudulent information are more likely to result in borrower default. This increases the risk exposure for lenders and can lead to a higher rate of loan delinquencies and foreclosures.

Loss of Trust:

Instances of fraud erode trust between lenders, borrowers, and investors. This loss of trust can lead to reluctance in lending, reduced investment in mortgage-backed securities,

and a general decline in confidence in the mortgage industry.

Complex Fraud Schemes:

Fraudsters continuously evolve their tactics, challenging fraud detection and prevention. Sophisticated schemes often involve multiple layers of deception, requiring advanced technologies and strategies to uncover.

Data Security Concerns:

The collection and storage of sensitive borrower information pose data security risks. Fraudsters may exploit vulnerabilities in systems to access and manipulate data, increasing the likelihood of fraudulent activities going undetected.

The Solution

Addressing challenges stemming from income and property fraud requires a multi-faceted approach that combines robust security measures, advanced technologies like AI, and ongoing collaboration between industry stakeholders and regulatory bodies.

Alone ‘Artificial Intelligence’ (AI) is revolutionizing the mortgage industry by enhancing fraud detection capabilities, particularly in income and property fraud. Here’s how AI is making a significant impact:

Leveraging AI for Detecting Income Fraud in Mortgages –

Intelligent Document Processing (IDP) is transforming income fraud detection in the mortgage industry by automating and enhancing the accuracy of document analysis. Traditional methods of verifying income involve manual processes prone to human error and manipulation. IDP leverages advanced technologies like Optical Character Recognition (OCR), Machine Learning (ML), and Natural Language Processing (NLP) to efficiently extract and validate information from income documents.

IDP systems can quickly scan and interpret various formats of income-related documents, such as pay stubs, tax returns, and bank statements, identifying inconsistencies or anomalies that may indicate fraud. By cross-referencing data from multiple sources, IDP ensures that the information provided by applicants is accurate and consistent. This reduces the risk of fraudulent activities and improves the reliability of the mortgage approval process.

Moreover, IDP enhances the speed and efficiency of processing mortgage applications, allowing lenders to make faster, more informed decisions. By automating routine tasks, IDP frees up human resources to focus on more complex cases and customer service, ultimately leading to a more streamlined and secure mortgage lending process. As a result, IDP plays a crucial role in mitigating income fraud and safeguarding the integrity of the mortgage industry.

Leveraging AI for Detecting Property Fraud in Mortgages –

Intelligent document processing (IDP) significantly improves property fraud detection in the mortgage industry by automating the extraction, validation, and analysis of document data. By leveraging machine learning and natural language processing, IDP quickly identifies inconsistencies, anomalies, and fraudulent information across various documents such as title deeds, income statements, and property appraisals. This technology ensures data accuracy, reduces manual errors, and flags suspicious activities for further investigation. Additionally, IDP enhances compliance with regulatory standards and speeds up the verification process, making fraud detection more efficient and reliable, ultimately protecting lenders and borrowers from potential financial losses.

Conclusion

In the dynamic landscape of the mortgage industry, the integration of ‘Artificial Intelligence’ (AI) is proving to be a game-changer in combating income and property fraud. AI algorithms analyze vast data sets with unparalleled speed and accuracy, flagging anomalies and patterns that signify potential fraudulent activities.

By leveraging AI technologies like intelligent document processing, the mortgage industry can proactively detect and prevent income and property fraud, minimize financial losses, maintain regulatory compliance, reduce the risk of default, preserve trust among stakeholders, counter complex fraud schemes, and enhance data security measures.

Experience intelligent automation in income and property fraud detection for the mortgage industry, with DocVu AI.