Think back, have you ever felt stressed when the due date of an invoice gets nearer? Although customers cannot directly see it, it is essential for the company to always meet invoice deadlines and make accurate entries in the accounts. This blog post is all about invoices starting with an analysis of the process and going through the need for automation and the possible effects on the business in 2024.

What is Invoice Processing?

Invoice processing refers to the step-by-step handling of invoices from when they get into your organization to payment and documentation. They are the bedrock of accurate financial operations because they allow the organization’s managers to provide accurate vendor payments while offering clear records.

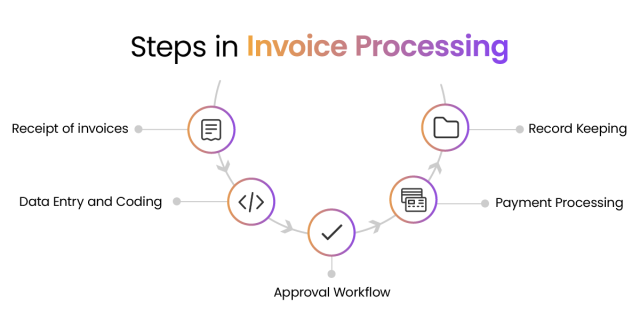

Here are the five Key Steps of Invoice Processing:

Step 1: First, invoices may be received through physical mail, email attachments, and electronic data interchange (EDI).

Step 2: The next stage is ‘Data Entry and Coding’ where information such as an invoice number, the amount paid to the vendor, and line items on the invoice are compiled. This information is then input into the accounting system and structure for accurate recording (for example; stationery, and advertisement expenses).

Step 3: After that comes ‘Approval Workflow’. Depending on the size of the invoice, authorized people check it for accuracy and alignment with purchase orders, contracts, or receiving reports. This phase prevents duplicate payments and assures compliance with business policies.

Step 4: The next is ‘Payment Processing’. Once approved, the invoice is then due for payment at the agreed time frame (for instance, net 30 days). This involves making a payment and an adjustment of the records in the form of a check or electronic transfer.

Step 5: After this comes ‘Record Keeping’. Paid invoices are securely saved for future reference and audits. Digital copies provide for easy retrieval and disaster recover

Manual vs. Automated Invoice Processing: A World of Difference

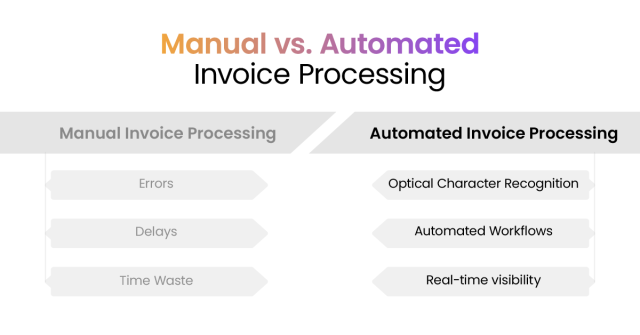

To put it into perspective, manual and automated processing of invoices has several differences. Traditionally, invoice processing involved manual paperwork on invoices or simple data entry programs.

This manual method is prone to:

- Errors (data entry mistakes, misplaced invoices),

- Delays (waiting for approvals),

- Wastages of important employee time.

Enter automation! Modern invoice processing software that uses unique features such as:

- Optical Character Recognition (OCR): Captures data from bills that have been scanned or even in PDF formats, thus greatly reducing the time spent on data entry and less chance of making errors.

- Automated Workflows: Automates the approval process by identifying persons for every bill and processing the bills according to set procedures.

- Real-time visibility: Offers the tracking of the invoice status from all the stages to ensure that timely payments are made hence avoiding late fees.

Advantages of Automating Your Invoice Processing:

- Increased Efficiency: Enables your team to spend more time on strategic initiatives.

- Improved Accuracy: Reduces human errors and standardizes data.

- Faster Processing: Organizes workflows to expedite approvals and payments.

- Cost savings: Cuts on expenses incurred on manual labor while, at the same time eliminating the use of paper.

- Enhanced cash flow control: Enhances the cash flow’s efficiency because one can get real-time information about upcoming payments.

Industries Leading in Automated Invoice Processing:

The beauty of automation is its adaptability. Here are just a few industries that get the maximum benefits from such automation

- Mortgage: Automate the large volume of invoices related to loan processing, appraisals, and origination to ensure timely payments to multiple vendors.

- Fintech: Improve the client experience by streamlining recurring bills for services such as software subscriptions and expediting payments.

- Insurance: Automate claim processing by gathering data from bills filed for repairs or medical treatments, resulting in speedier payouts to policyholders.

Intelligent Document Processing Is Transforming Invoice Processing with a Plethora of Benefits :

Improved data capture and conversion.

Intelligent document processing (IDP) transforms accounts payable by processing a variety of invoice formats, including pictures, PDFs, and email text. These technologies locate, extract, and transform data into a structured format, simplifying the first phases of accounts payable automation. This includes matching invoices to purchase orders, receiving documents, and routing them for approval before payment.

Efficiency and Accuracy for Data Entry

IDP has quickly automated the initial stage of data entry and verification, which was previously time-consuming and error-prone. IDP takes data in less than 60 seconds, but rules-based software might take two to five minutes for each invoice. This huge increase in speed is accompanied by greater accuracy; whereas human data input accuracy is roughly 80%, IDP can achieve up to 98 percent accuracy.

Continuous Improvement through Machine Learning.

One of the most notable qualities of IDP is its capacity to learn and improve over time. IDP’s machine learning component means that it not only begins with a high level of accuracy but also continuously improves its performance, lowering errors and processing times. This revolution in invoice processing enables businesses to manage accounts payable more efficiently and precisely than ever before.

IDP from DocVu.AI Is Your Key to Seamless Invoice Processing:

DocVu.AI, an AI-powered IDP platform, is here to revolutionize invoice processing.DocVu.AI goes beyond basic automation, offering:

- Intelligent data extraction:

Extracts data with high accuracy, even from complex invoices with different formats. - Workflows Based on Machine Learning:

Adapts to your approval processes, resulting in smoother routing and speedier approvals. - Real-time Analytics:

Present intelligent dashboards for tracking key performance indicators, trends, and patterns, and making sound financial decisions.

Are you ready to have an efficient system of invoice processing instead of wasting much time and effort?

Then contact us today to see how DocVu.AI can help your team increase your bottom line at www.docvu.ai

Also watch out for our upcoming blog series, in which we will answer your most often-asked questions about invoice processing.