Are you aware that in the world of finance and accounting, properly managing a vast array of documents can save delays and errors?

It is here that AI plays a critical role in mitigating both and thereby streamlining the finance and accounting processes of an organization.

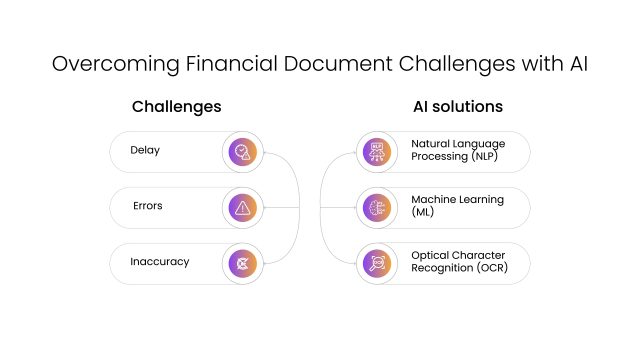

The Problem

The two most critical factors that hinge on regulatory penalties and future business opportunities are the elimination of

– Delays

– Errors

– Non-accuracy

But before we proceed further, let us first look a bit more closely into these two areas.

(a) Factors causing delays in financial documentation

- The retrieval of information from a vast array of data takes more time as the number and scale of documents increase in volume.

- Complexities arising from different document structures and formats invariably cause a longer processing time.

- The evolving landscape of regulatory requirements for compliance adds to the delays.

(b) Factors causing errors in financial documentation

- Multiple stages of processing, review, and approval before arriving at the acceptance stage involve multiple human interventions, leading to a higher scope of errors.

- Regulatory authorities‘ pressure for quick compliance requires a faster turnaround time, leading to more human errors in documentation.

(c) Factors causing inaccuracy in financial data

Inaccuracy in financial documentation often stems from two primary factors.

- Firstly, the lack of data validation mechanisms results in the inclusion of incorrect or inconsistent data, compromising accuracy.

- Secondly, incomplete or inaccurate data entry, often due to human errors like misinterpretation or typographical mistakes, further contributes to the problem. These factors highlight the critical need for robust validation processes and meticulous data entry procedures to ensure the integrity and reliability of financial documentation, ultimately enhancing decision-making and organizational transparency.

(d) Effects of these two factors on the organization’s functioning

- Delays in Invoice processing is one area that affects the finance and accounts department but has a wider ramification across the entire revenue generation of the organization.

- Another direct effect of the delay in invoice processing is rising processing costs. According to an estimate by the Institute of Finance and Management (IOFM), it has been found that the expenses linked with invoice processing range from $1 to $21. Therefore, any delay will eventually increase the cost and affect the revenue of the business.

The Solution

(a) Integrating various components of AI technologies for a complete transformation

- Natural Language Processing (NLP) serves as a transformative force, enabling machines to not only comprehend but also interpret human language with precision. By extracting nuanced meanings from unstructured text, identifying entities such as names, dates, and financial figures, and grasping contextual nuances, NLP algorithms contribute significantly to the automation of tasks and the improvement of user experiences in diverse applications.

- Machine learning (ML) algorithms, trained on extensive historical datasets, exhibit a remarkable ability to discern intricate document structures, accurately extract relevant information, and proficiently categorize the content. This capacity enables ML systems to streamline processes across various industries, enhancing efficiency and decision-making.

- Optical Character Recognition (OCR) technology plays a pivotal role in the digital transformation of physical documents. This process involves the accurate identification of characters, digits, symbols, and structural elements, ensuring the conversion of physical documents into actionable and searchable digital data. OCR’s ability to precisely capture and interpret complex textual and graphical content elevates its importance in modern document management systems, enhancing accessibility, efficiency, and data accuracy.

By leveraging OCR, organizations can automate invoice data extraction, significantly reducing manual data entry efforts and minimizing the risk of human errors. This advancement enables the integration of paper-based invoices into digital workflows, streamlining the entire invoicing process. This enhanced efficiency accelerates invoice processing times, enabling timely payments to vendors and optimizing financial operations within the organization.

Thus, OCR technology plays a crucial part in modernizing invoice management processes, enhancing productivity, and improving financial decision-making capabilities.

(b) Turnaround with AI: critical outcomes

- Ensuring scalability with increased financial data and thereby being able to maintain operational efficiency over time.

- Safeguarding confidential financial information throughout the document lifecycle is ensured with automated document processing done with the power of AI.

- Smooth integration with existing software and workflows allows more operational flexibility without the need for a complete overhaul of legacy systems.

- Efficiency in information retrieval is significantly enhanced by AI, as it automates the extraction of relevant information from financial documents. This not only reduces the need for manual effort but also leads to a concurrent improvement in data accuracy. By leveraging AI technology, organizations can streamline their information retrieval processes, resulting in more efficient operations and better decision-making capabilities.

- AI models exhibit heightened accuracy and consistency at scale, showcasing their adeptness in extracting and categorizing data with precision. This proficiency not only reduces human errors but also guarantees uniformity across financial documents. By harnessing their ability to comprehend and generate human-like text, generative models significantly enhance the accuracy of data extraction and improve contextual comprehension within financial documents. This enhanced accuracy and understanding pave the way for more reliable and insightful analysis of financial data, leading to better decision-making and risk management strategies.

Conclusion:

Incorporating AI into financial document processing represents a significant transformation in the financial industry. AI-powered tools and methodologies have fundamentally changed traditional approaches, empowering finance professionals with advanced capabilities for document analysis, information extraction, compliance management, and strategic decision-making. This evolution towards AI-driven solutions has not only streamlined operations but also enhanced the accuracy, efficiency, and agility of financial institutions, ultimately leading to more informed and effective business strategies.

Experience the transformative power of AI with DocVu.AI by connecting with us.