In today’s competitive mortgage industry, meeting customer expectations is paramount. With a plethora of options available, borrowers are no longer just looking for the best rates—they seek exceptional service that simplifies the complex mortgage process. As customer expectations evolve, so must the service offerings of mortgage providers. This blog explores how enhancing service quality, leveraging advanced technologies, and adopting a customer-centric approach can help mortgage companies not only meet but exceed customer expectations, fostering loyalty and driving growth in an increasingly demanding market.

Hurdles Faced in Improving Service Quality for Mortgage Industry Players

Improving mortgage service offerings to meet customer expectations presents a multifaceted challenge for the industry. Addressing these challenges is key to enhancing service offerings and meeting customer expectations in the mortgage industry.

- One of the primary obstacles is the complexity and length of the mortgage application process, which can be daunting and time-consuming for customers. Streamlining this process without compromising thoroughness and compliance is a significant hurdle. Additionally, there is the challenge of integrating advanced technology while ensuring data security and privacy, which is crucial given the sensitive nature of financial information.

- Another challenge is addressing the diverse needs and expectations of customers. With a wide range of borrowers, from first time homebuyers to seasoned investors, tailoring services to meet individual requirements is essential but complex. This includes offering personalized advice and support, which requires a deep understanding of each customer’s financial situation and goals.

- Moreover, the industry faces regulatory changes and market fluctuations that can impact service offerings. Staying agile and adaptable while maintaining high service standards is critical. Lastly, there is the issue of customer communication. Ensuring clear, consistent, and timely communication throughout the mortgage process is vital for building trust and satisfaction but can be difficult to achieve consistently.

Addressing Key Challenges by Adding Intelligent Automation for Improving Service Offerings

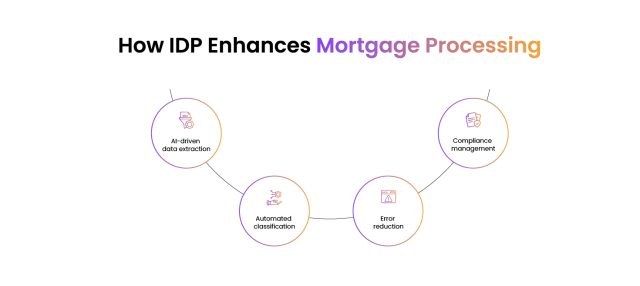

In the competitive landscape of the mortgage industry, enhancing service offerings is crucial to meet rising customer expectations. Intelligent automation emerges as a powerful solution, addressing key challenges through innovative technologies. Central to this transformation is intelligent document processing (IDP), which streamlines and automates the handling of vast amounts of paperwork. By leveraging IDP, mortgage providers can significantly reduce manual errors, accelerate processing times, and ensure compliance. This not only enhances operational efficiency but also delivers a seamless, faster, and more accurate service experience for customers, ultimately boosting satisfaction and trust in the mortgage process.

Intelligent Document Processing (IDP) is a crucial component of Intelligent Automation that significantly enhances mortgage service offerings by addressing key challenges in the industry. IDP leverages AI, machine learning, and natural language processing to automate the extraction, classification, and validation of data from various mortgage-related documents. This advanced technology streamlines the traditionally manual, error prone processes, leading to increased accuracy and efficiency.

- One of the primary challenges in the mortgage industry is the sheer volume of paperwork involved, which often results in delays and errors. IDP mitigates these issues by quickly and accurately processing large quantities of documents, ensuring that critical information is captured correctly and reducing the risk of human error. This acceleration in document handling speeds up the mortgage approval process, enhancing customer satisfaction by providing quicker responses and reducing the waiting period.

- Furthermore, IDP improves compliance with regulatory requirements by ensuring that all necessary documentation is accurately processed and easily retrievable. This reduces the risk of non-compliance penalties and builds trust with customers who expect a secure and reliable service.

By integrating IDP into their processes, mortgage providers can offer a more efficient, accurate, and customer-centric service, meeting and exceeding customer expectations in an increasingly competitive market.

In conclusion, intelligent automation has emerged as a powerful solution to the myriad challenges facing the mortgage industry in its quest to improve service offerings and meet customer expectations. By integrating intelligent document processing (IDP), mortgage lenders can streamline the traditionally cumbersome and error-prone task of handling vast amounts of paperwork. IDP leverages technologies such as optical character recognition (OCR) and machine learning to accurately extract, classify, and validate data from various document types. This not only accelerates the loan processing time but also significantly reduces the risk of human error, ensuring higher accuracy and compliance. Moreover, the automation of routine tasks frees up valuable time for mortgage professionals, allowing them to focus on delivering personalized customer service. As a result, customers experience faster turnaround times, greater transparency, and improved satisfaction. Intelligent automation, with its ability to transform document-centric processes, is not just an enhancement but a fundamental shift towards a more efficient, customer-centric mortgage industry. This transformation ultimately positions lenders to better meet the evolving needs and expectations of their clients, fostering trust and long-term loyalty in an increasingly competitive market.

Connect with DocVu.AI to experience intelligent document processing solutions.