In the ever-evolving landscape of mortgage lending, challenges can feel overwhelming. Yet,

data integration stands as a powerful remedy to streamline these processes. By leveraging

robust data integration strategies, lenders can vastly improve operational efficiency and

resource management, paving the way for portfolio growth. This becomes especially vital during the application and onboarding stages, where seamless data integration minimizes errors, speeds up decision-making, and boosts customer satisfaction. In this blog, we delve into how embracing data integration can help mortgage lenders tackle underwriting challenges and achieve business success.

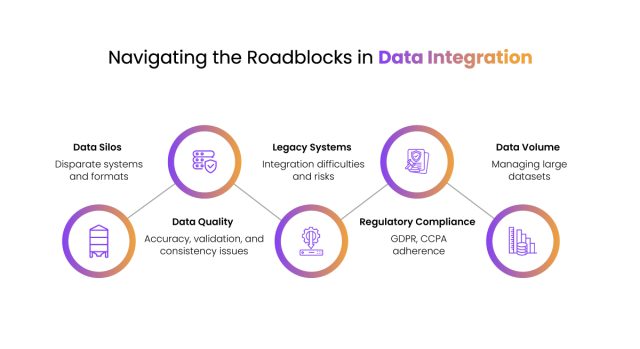

Roadblocks in Efficient Data Integration

Data integration in the mortgage industry presents numerous challenges due to the complexity and diversity of data sources

Data Silos:

Data silos are a prevalent issue in the mortgage industry. Information is often stored in disparate systems and formats, making it difficult to consolidate and analyze comprehensively. This fragmentation hinders seamless data flow, leading to inefficiencies and potential errors.

Data Quality:

Maintaining high data quality is another significant challenge. Inaccurate or incomplete data can stem from manual entry errors, outdated information, or discrepancies across sources. Ensuring reliable data requires rigorous validation and cleansing processes, which are resource-intensive.

Legacy Systems:

Many mortgage companies rely on outdated technology that lacks compatibility with modern

systems. These legacy systems create barriers to efficient data integration and increase the risk of data loss or corruption during migration.

Regulatory Compliance:

Adhering to strict data governance and privacy regulations, such as GDPR and CCPA, adds

complexity to data integration. Mortgage companies must ensure compliance while integrating data from multiple sources, necessitating robust security measures and meticulous documentation.

Data Volume:

The sheer volume of data generated in the mortgage process, from application to closing, poses another challenge. Managing and integrating this vast amount of data requires scalable and efficient solutions. Implementing advanced technologies like AI and machine learning can help address these issues but demands significant investment and expertise.

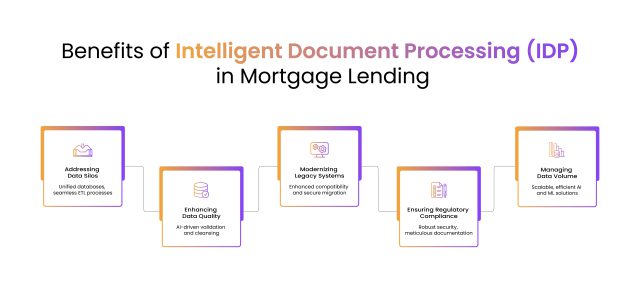

Overcoming Data Integration Challenges with Intelligent Document Processing

Intelligent Document Processing (IDP) revolutionizes data integration in the mortgage industry by addressing critical challenges such as data silos, quality, legacy systems, regulatory compliance, and data volume. By leveraging advanced technologies like AI and machine learning, IDP streamlines data consolidation, enhances accuracy, modernizes outdated systems, ensures compliance, and efficiently manages vast amounts of data.

Addressing Data Silos:

Intelligent document processing (IDP) effectively tackles data silos by consolidating information from various systems and formats into a unified database. Through advanced technologies like optical character recognition (OCR) and machine learning, IDP enables seamless extraction, transformation, and loading (ETL) of data. This integration enhances data flow, reduces inefficiencies, and minimizes the risk of errors.

Enhancing Data Quality:

IDP significantly improves data quality by automating validation and cleansing processes. By

leveraging AI algorithms, IDP can detect and correct inaccuracies, fill in missing information,

and ensure consistency across data sources. This automated approach not only enhances the

reliability of the data but also reduces the resource-intensive nature of manual data validation.

Modernizing Legacy Systems :

IDP aids in modernizing legacy systems by facilitating the integration of outdated technologies

with contemporary platforms. This integration minimizes the risk of data loss or corruption during migration and enhances overall system compatibility. Consequently, mortgage companies can achieve more efficient and secure data integration processes.

Ensuring Regulatory Compliance:

With stringent data governance and privacy regulations, IDP provides robust security measures and meticulous documentation capabilities. IDP ensures that data integration processes adhere to regulations such as GDPR and CCPA, safeguarding sensitive information and maintaining compliance across all data sources.

Managing Data Volume:

The vast amount of data generated in the mortgage process can be overwhelming. IDP offers

scalable and efficient solutions to manage and integrate this data. By utilizing AI and machine

learning, IDP can handle large volumes of data, streamlining the mortgage process from

application to closing.

In conclusion, we can say by adopting IDP, mortgage companies can streamline their

operations and achieve a more efficient data integration process that results in –

– Streamlining Data Consolidation:

Intelligent Document Processing (IDP) addresses data integration challenges by breaking down silos and consolidating information, ensuring seamless data flow and enhancing efficiency. Additionally, DocVu’s in-built Document Management System integrates OCR and Non-OCR workstreams effectively and helping manage data seamlessly.

– Enhancing Accuracy and Compliance:

Leveraging AI and machine learning, IDP improves data accuracy and quality, ensures

regulatory compliance, and manages large data volumes, leading to improved customer service and operational excellence.

To experience this ‘intelligent automation’ in data integration with intelligent document processing, connect with DocVu.AI at : www.docvu.ai