Introduction

In today’s world, where digital transformation is enhancing customer experiences across various industries, the mortgage sector often tells a different story. Here, manual processes and unexpected delays frequently result in customer dissatisfaction. For instance, according to ValuePenguin, mortgage lenders spend an average of 24 to 72 hours underwriting each loan . Additionally, Ellie Mae, a leading mortgage software company, reports that the average time to close a mortgage loan in the United States is currently 47 days.

However, with the advent of artificial intelligence making waves everywhere, the mortgage industry isn’t immune. Today, AI has transformed the way compliance review, fraud detection, property valuation, underwriting data verification, processing, and so on and so forth used to be.

The Problem

While the quest for a mortgage offer unfolds against a backdrop of potential hurdles,

understanding and addressing the factors that influence processing times can help aspiring homeowners navigate the mortgage maze with confidence, inching closer to the keys of their dream abode.

Unveiling the Secrets Behind Mortgage Application Delays

Let’s delve into the intricate web of factors that could potentially slow down your mortgage application, shedding light on a question that has echoed through the corridors of homebuying for over a decade: How many man-hours does it take to receive your mortgage offer?

At the very onset, one can classify these factors into two broad categories:

A. Factors involving the lender’s side

B. Factors involving the borrower’s side

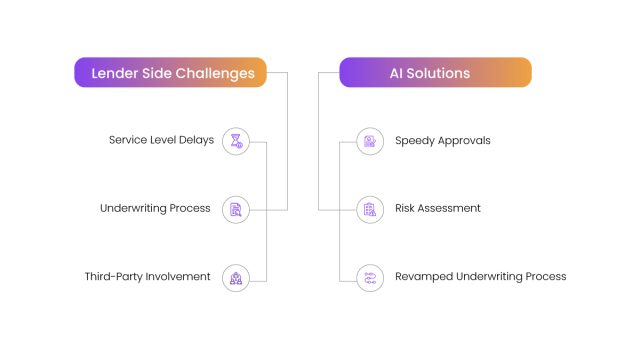

Factors involving the lender’s side

- Lender’s Service Levels:

Mortgage lenders face significant service level delays due to multifaceted challenges in the loan origination process. Accurately assessing borrower credit risk, adhering to complex and evolving regulations, and preventing fraud are critical tasks that hinder operational efficiency. These delays negatively impact customer satisfaction, as timely service is essential in the fiercely competitive mortgage industry. - The lender’s underwriting process:

Each lender boasts a distinct underwriting process, ranging from meticulous document scrutiny to embracing digital tools for streamlined verification. Embracing automation can accelerate offer issuance, highlighting the significance of leveraging a knowledgeable broker who can navigate these nuances for a swifter outcome. - Involvement of Third Parties:

Beyond the lender-applicant dynamic, third-party stakeholders like surveyors and accountants can influence the speed of your mortgage offer. Surveyor availability for property valuation or accountant responsiveness in verifying financial details can introduce additional variables, warranting proactive engagement and realistic expectations.

Factors involving the borrower’s side

Personal Circumstances and Credit History: Your unique circumstances, from employment stability to credit history intricacies, play a pivotal role in shaping the mortgage application timeline. While a straightforward financial profile can expedite document processing,

complexities such as self-employment or past credit challenges may necessitate thorough affordability assessments, potentially elongating the process.

The Solution

The process of mortgage loan application processing can be quite time-consuming, yet customers expect swift results. Outsourcing mortgage processing stands out as a highly effective strategy for reducing turnaround times. Mortgage application processing service providers boast qualified teams, advanced technology, and round-the-clock operations, ensuring speedy turnarounds.

The integration of AI and machine learning technologies has significantly transformed the lending landscape, offering various benefits and opportunities for lenders.

Revolutionizing Application Processing

Speedy Approvals

Traditionally, obtaining mortgage approval could take weeks or even months as documents were reviewed, validated, and authorized by multiple departments.

But with AI-driven IDP systems one can quickly and accurately extract relevant information from a variety of documents required in mortgage applications, such as tax returns, pay stubs, and bank statements. By automating data extraction and validation, AI minimizes the need for manual data entry and reduces the risk of errors. This speeds up the loan approval process significantly, allowing lenders to provide quicker responses to applicants.

Risk Assessment

The speed at which IDP processes documents drastically reduces the time required for risk

assessment. What once took days or even weeks can now be accomplished in a matter of hours. This accelerated process not only improves operational efficiency but also enhances the customer experience by providing faster loan approvals. Applicants receive quicker responses, reducing the uncertainty and stress associated with the mortgage application process.

Revamping the Underwriting Process

Intelligent Document Processing (IDP) is transforming the mortgage underwriting process by automating the extraction, classification, and validation of information from various documents. This advanced technology leverages AI and machine learning to accurately and swiftly process data, reducing the manual workload for underwriters. As a result, the time required to review and approve mortgage applications is significantly shortened, enhancing efficiency and reducing the risk of errors. By streamlining these tasks, IDP ensures faster and more reliable mortgage application processing, benefiting both lenders and borrowers.

In conclusion, the reason for longer man hours in mortgage application processing is due to several lengthy procedures and formalities such as title checks, verifications, valuations, and tax reports. To enhance the borrower experience, lenders are under pressure to expedite loan processing while staying compliant with regulations.

It is here that technology like intelligent document processing plays a crucial part in reducing turnaround times

Intelligent Document Processing or what is popularly called IDP is revolutionizing the mortgage loan application process by significantly improving efficiency and reducing costs. By leveraging advanced technologies like artificial intelligence (AI), machine learning, and optical character recognition (OCR), IDP automates the extraction, classification, and validation of data from various documents. This automation minimizes manual data entry errors and speeds up the processing time, allowing lenders to handle a higher volume of applications with greater accuracy. Consequently, the streamlined process reduces operational costs and enhances customer satisfaction by providing faster loan approvals and a smoother overall experience.

To know more about this transformative power of AI, connect with us to experience DocVu.AI.