Insurance Claims Processing

Streamline Insurance Claims Processing with Automation and Outsourcing

Reduce the waiting time for customers with quick claims processing and accurate resolutions.

Lengthy claims processing driving away customers?

Insurance claims can become a time-taking procedure for the customers with multiple form fills, repeated back and forth between the insurers and customers, and delayed resolution due to redundant background operations. Consequently, the customer experience is affected and customer retention is reduced.

tHE SOLUTION

A scalable Automation solution for all insurance types

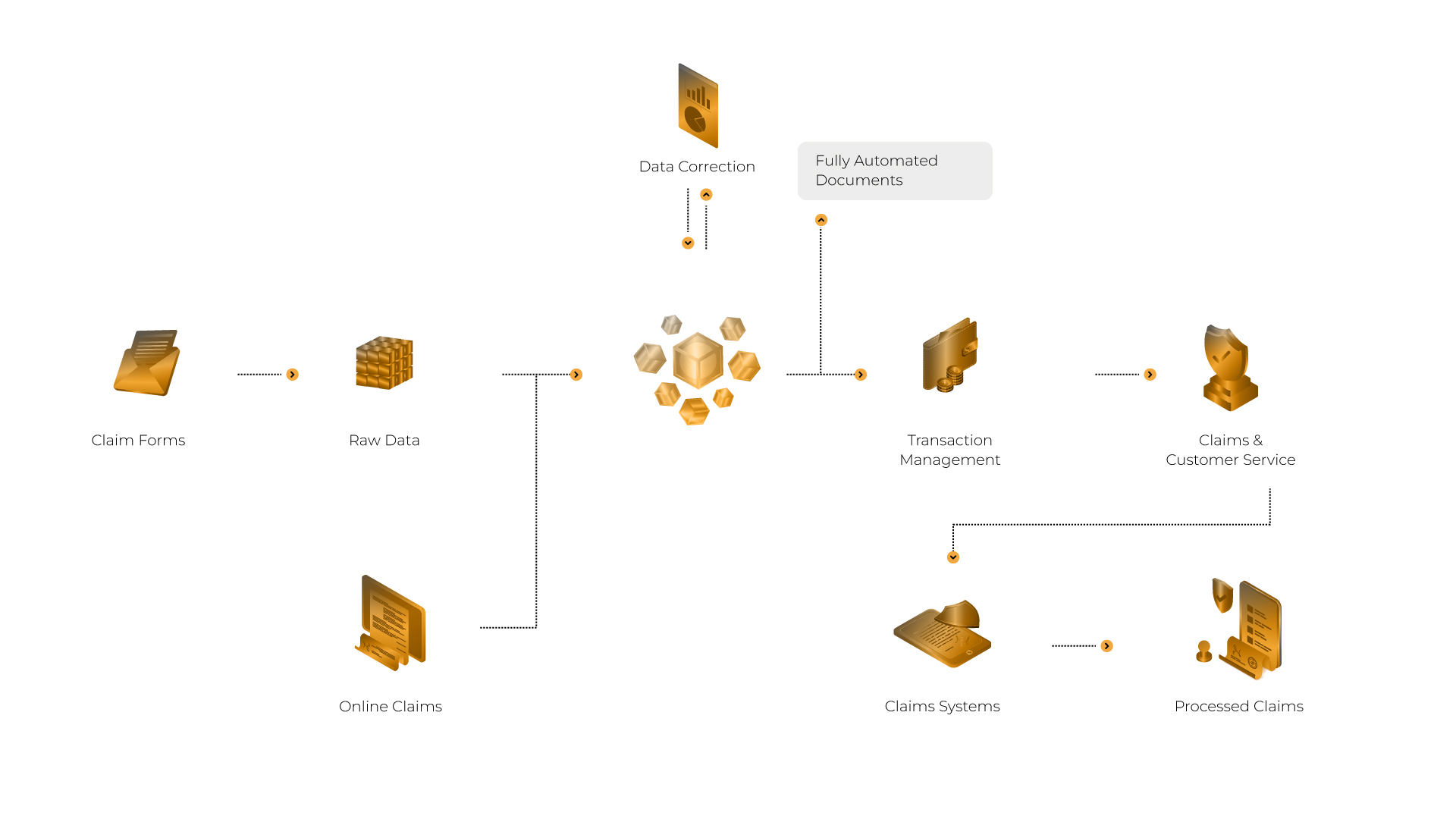

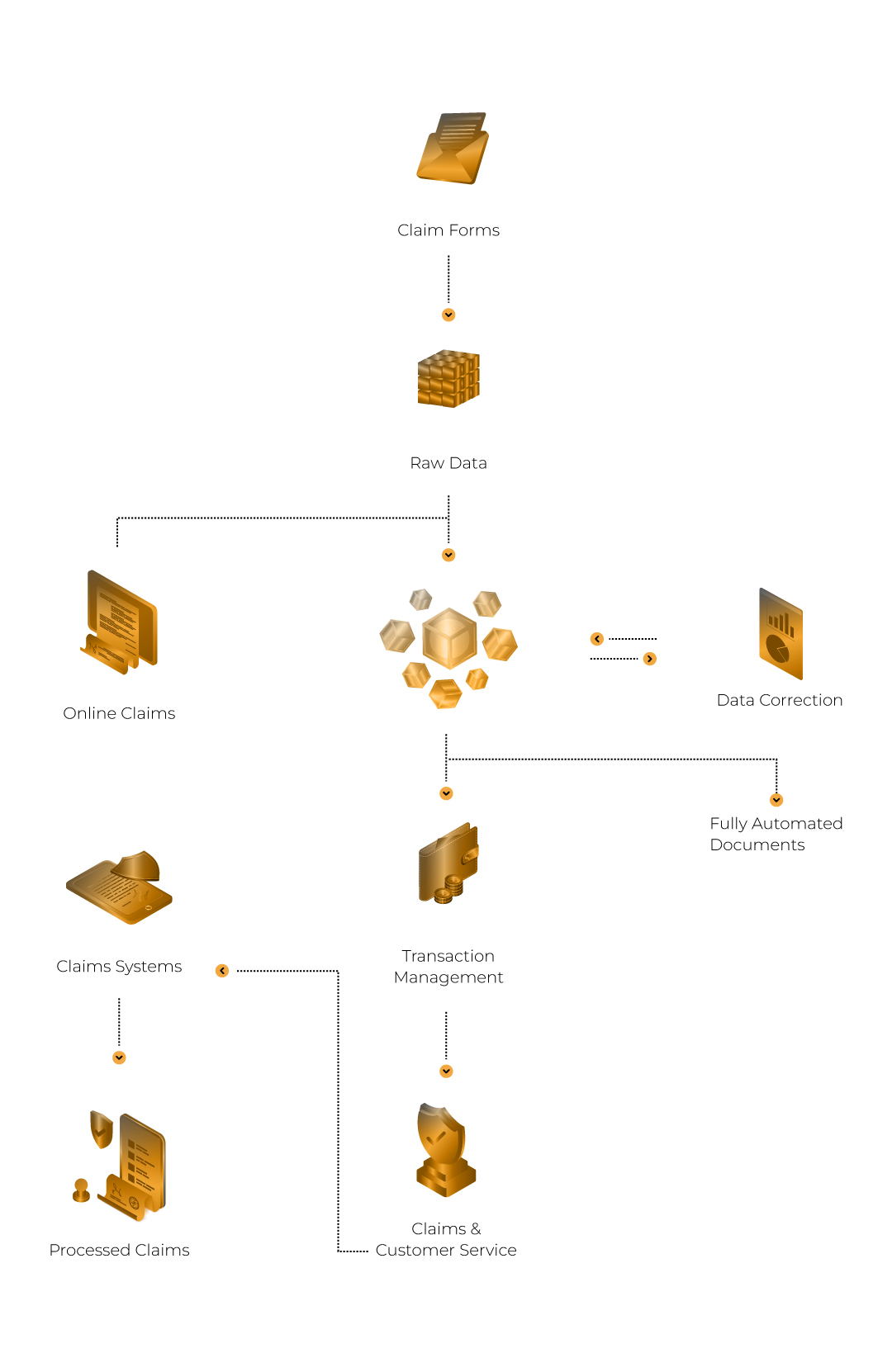

Process more claims and avoid discrepancies during validation to offer speedy resolution to your customers. DocVu.AI’s AI and ML-based business engine allows you to handle end-to-end claims processing with more confidence and provide faster settlements.

Applications

DocVu.AI Capabilities

Insurance Claims processing

Claims loss reporting

Eligibility verification

Review, adjust & settle

Maximize insurance claims approval with DocVu.AI, a document processing automation solution.

Improve your document processing speed and enhance your data extraction efficiency using DocVu.AI.

Case Studies

Stay informed with the latest on the Industries we work with and news updates from our company.

How DocVu.AI Revolutionized ‘Order to Cash Process’ for a Leading Pharma Chain

Please submit this form to download Case Study

Bank in North America to Achieve Excellence in Post-Close Audit using IDP solutions

Please submit this form to download Case Study

Knowledge Centre

Keep updated with our resources on mortgage industry and the latest company updates

7 emerging trends redefining post-closing audits in the digital mortgage era

When Wells Fargo disclosed a $37 million regulatory penalty in Q1 2024 due to post-closing audit failures, as reported by

How cloud-based document management enhances security and scalability in finance & accounting

In April 2024, Bloomberg revealed a 45% year-over-year surge in cyberattacks targeting financial institutions still reliant on on-premise document systems,

The future of Financial Recordkeeping: AI-driven automation, digitization, and secure archiving

Imagine a financial institution facing millions in regulatory fines not due to fraud or mismanagement, but simply because its recordkeeping

How would you like to partner with us?

Want to know how DocVu.AI makes document processing efficient? Get in touch with us!

Frequently Asked Questions

DocVu.AI offers AI-driven solutions for automating the insurance claims process, enhancing efficiency, accuracy, and speed.

AI automated document classification, data extraction, and validation, reducing manual errors and speeding up the claims process.

Benefits include faster claims processing, reduced operational costs, improved accuracy, and better customer satisfaction.

DocVu.AI employs advanced encryption and secure data handling practices to protect sensitive information.

Yes, DocVu.AI solutions are designed to integrate seamlessly with existing insurance platforms and workflows.