INVOICE PROCESSING

Streamline Accounts Payable with AI-led Invoice Processing Automation & Outsourcing Solutions

Enhance finance operations with AI-led invoice processing automation. Streamline accounts payable and outsource for efficient invoice automation.

Vulnerable to processing error?

Extracting data from multiple invoices across vendors can become a tedious task. Further, inconsistent formats, physical invoices, variable incoming sources, and missing line items can cause errors in extracting and recording the necessary data.

SOLUTION

Track invoices with seamless accuracy

DocVu.AI’s Intelligent invoice processing solution uses AI to identify, capture, classify, and record invoices automatically, irrespective of their formats, within minutes. DocVu.AI’s templateless invoice processing extracts information fast and eliminates efficiency bottlenecks to accelerate invoice management and track transactions effortlessly.

Value Propositions

Why AP teams prefer DocVu.AI to reduce invoice processing time?

DocVu.AI’s Intelligent Document Processing platform streamlines AP operations with greater agility, flexibility and accuracy.

Templateless and intelligent invoice processing

Fraud detection and signature verification

Accurate document indexing

Electronic issuance, transmission, and receiving of invoices

Choose AI-led Invoice Processing Automation and Outsource Your Invoice Management!

Make invoice processing efficient and accurate with DocVu.AI.

Case Studies

Stay informed with the latest on the Industries we work with and news updates from our company.

How DocVu.AI Revolutionized ‘Order to Cash Process’ for a Leading Pharma Chain

Please submit this form to download Case Study

Bank in North America to Achieve Excellence in Post-Close Audit using IDP solutions

Please submit this form to download Case Study

Unlock the Fast Track to Efficient

Invoice Processing using Al

Strengthen finance operations with Al-led Invoice Processing Automation. Now make Account Payable effective.

Knowledge Centre

Keep updated with our resources on mortgage industry and the latest company updates

Top 7 Document Hurdles in Non-QM Lending, solved by DocVu.AI.

In today’s lending landscape, borrower profiles are no longer uniform, and neither are their documents. As Non-QM lending becomes a

How Intelligent Document Processing (IDP) is Revolutionizing Enterprise Workflows

In today’s fast-paced digital world, businesses face the constant pressure to optimize efficiency, reduce costs, and stay ahead of the

Top 6 Pain Points in Mortgage Document Management and How DMSVu Fixes Them

In mortgage lending, document management has become a quiet drag on performance. From intake to audit, teams deal with scattered

How would you like to partner with us?

Want to know how DocVu.AI makes document processing efficient? Get in touch with us!

Frequently Asked Questions

Accounts Payable automation streamlines and automates tasks and workflows involved in managing and processing accounts payable functions using technology like software solutions and RPA.

AP automation captures invoices using intelligent OCR, validates data, routes them through approval workflows, and initiates payments, integrating with ERP systems for efficiency.

It captures invoice data using intelligent OCR, validates it, automates workflows, integrates with accounting systems, and provides reporting, reducing manual effort and errors.

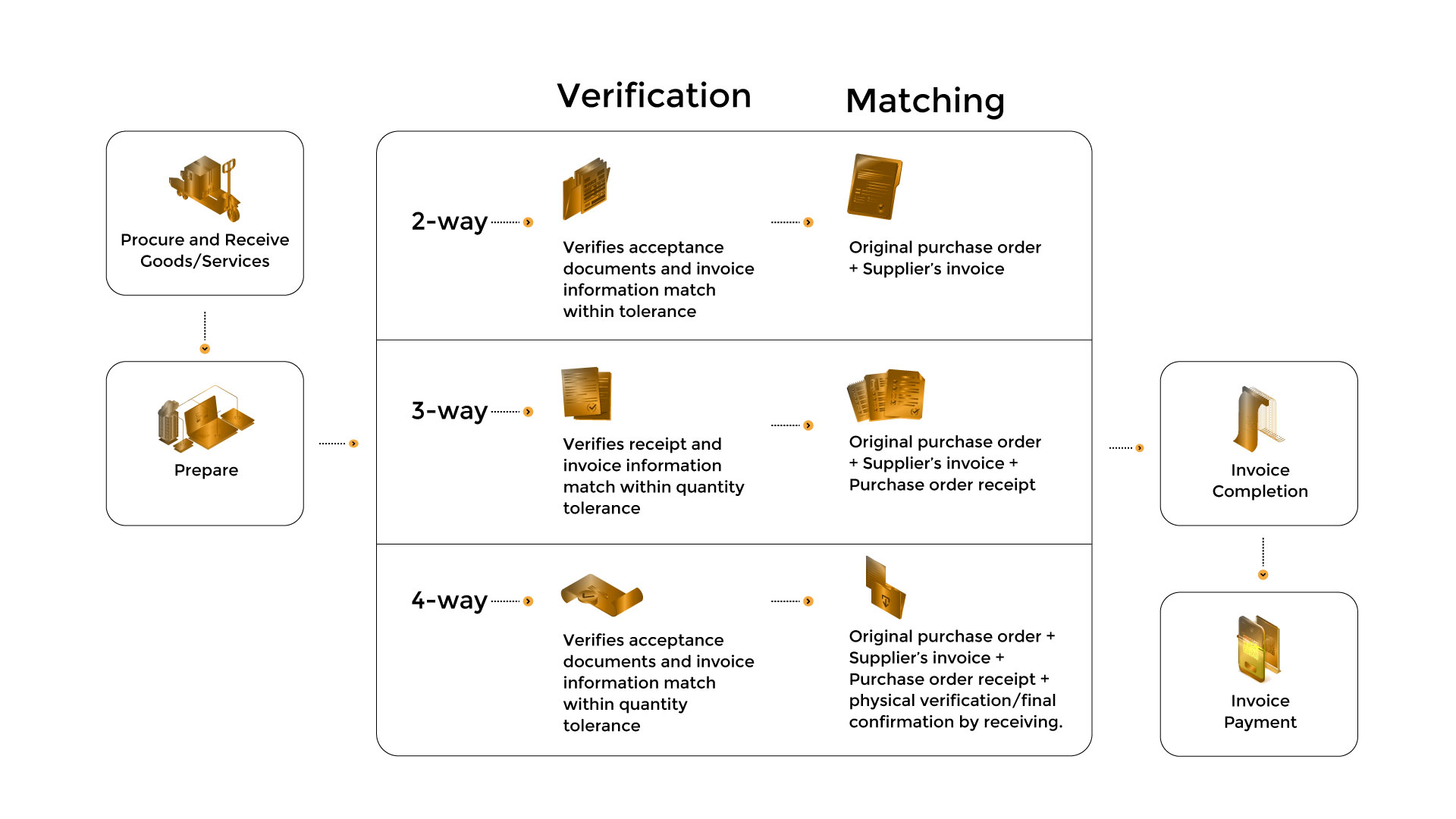

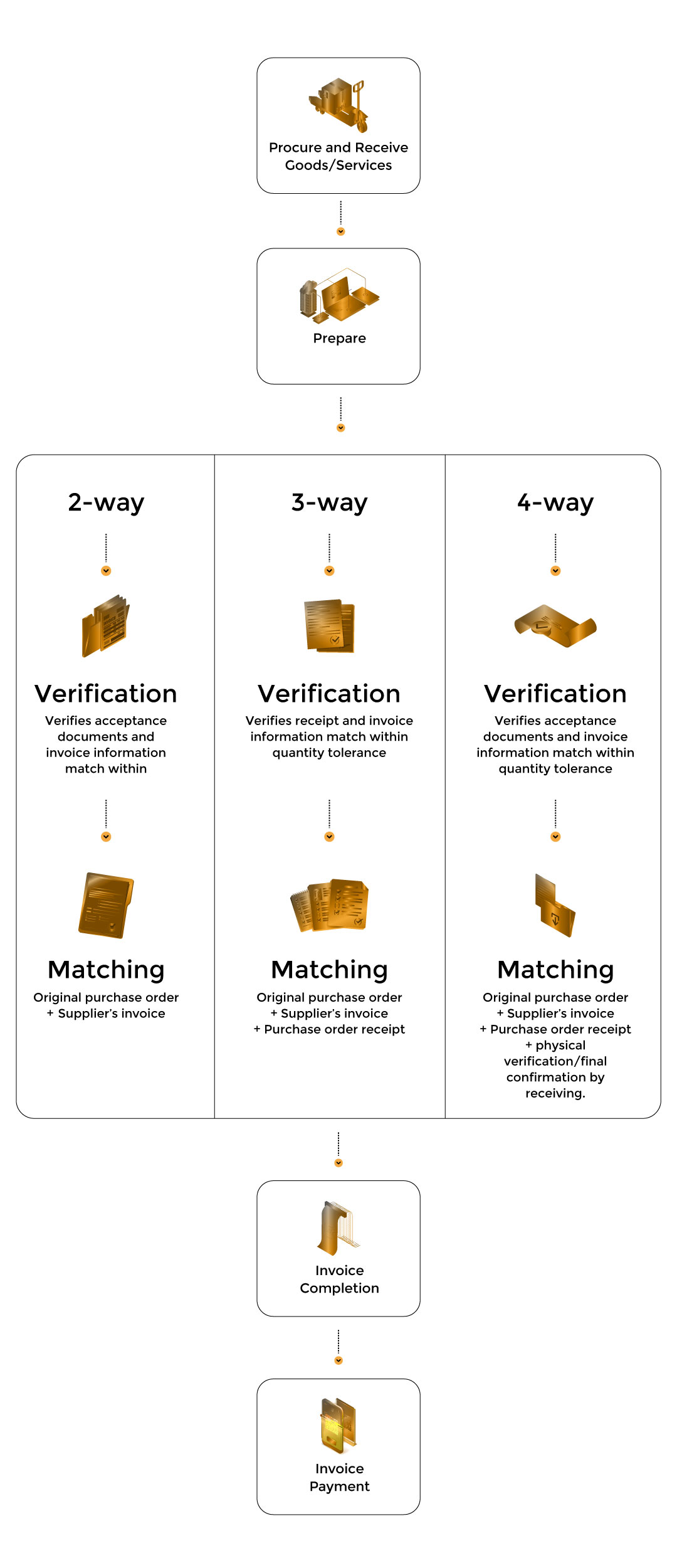

DocVu.AI uses intelligent OCR to extract data from invoices, validate it with a 3-way match process, automate approval workflows, and integrate with financial systems for continuous improvement.

Benefits include time and cost savings, improved efficiency and accuracy, enhanced vendor relationships, streamlined workflows, increased visibility and control, compliance, audit readiness, data analytics, and environmental sustainability.

Businesses can achieve significant savings, with estimates ranging from 40% to 80% reduction in invoice processing costs compared to manual processes.

The software uses fraud detection algorithms, performs validation checks, matches invoices with purchase orders, enforces approval workflows, manages vendor information, and maintains audit trails for fraud detection.