LOANS AND MORTGAGE PROCESSING

Accelerate loan processing and enhance efficiency with automated document processing for lightning-fast closures

Get ahead of market volatility and rate fluctuations with automated loan document processing and transform your operations.

Sluggish processes delaying your mortgage?

Multiple documents, error in data collection, and identifying the right documents can be time-consuming and error-prone when done manually. Further, any inconsistencies can cause processing delays and impact the final rates.

The Solution

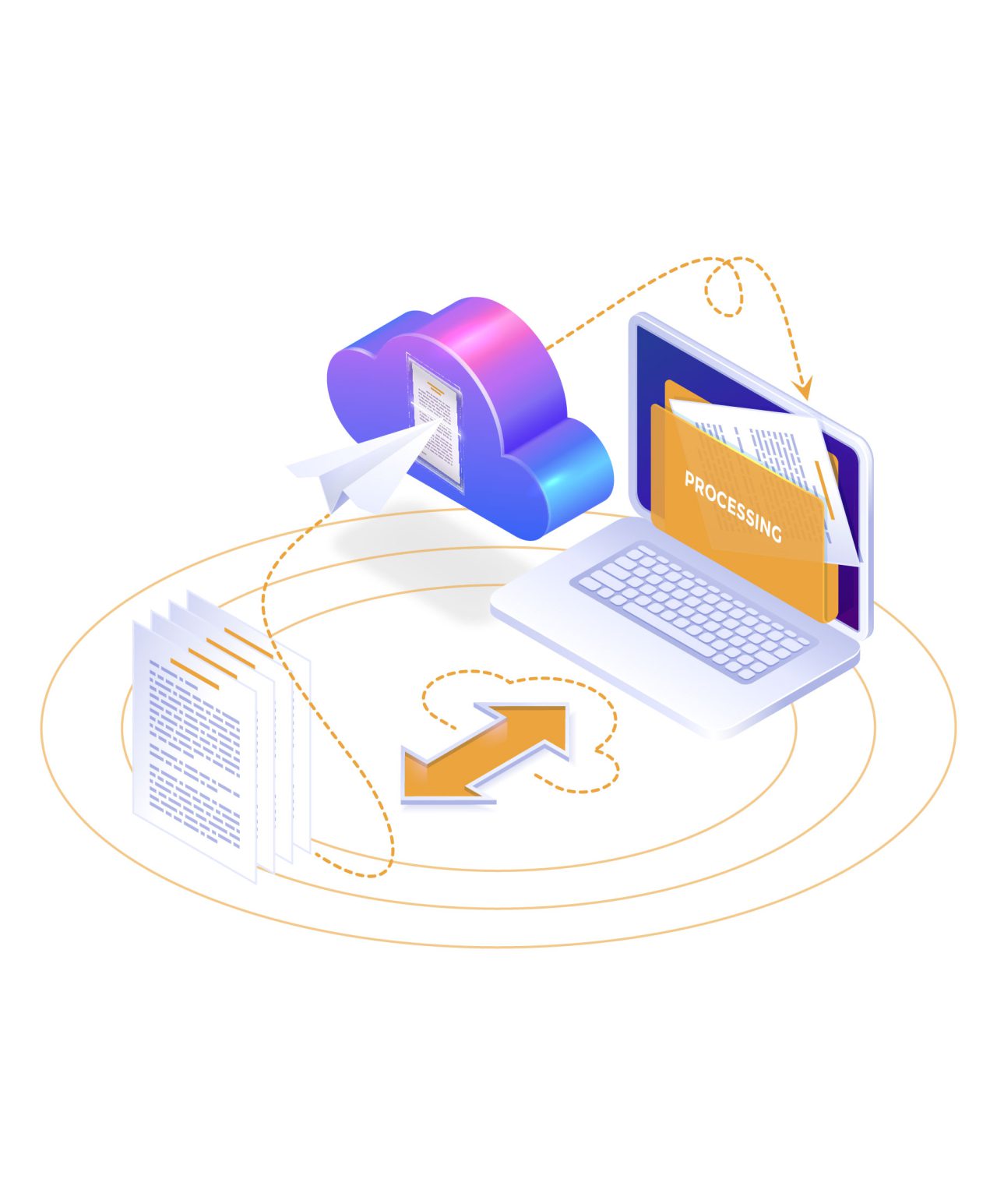

Automate mortgage document processing and close loans faster

Leverage DocVu.AI’s AI and ML-based mortgage processing platform to accelerate document processing and offer zero-error loans. Extract information from the mortgage documents by recognizing relevant data points and improve loan closure time with superior customer experience.

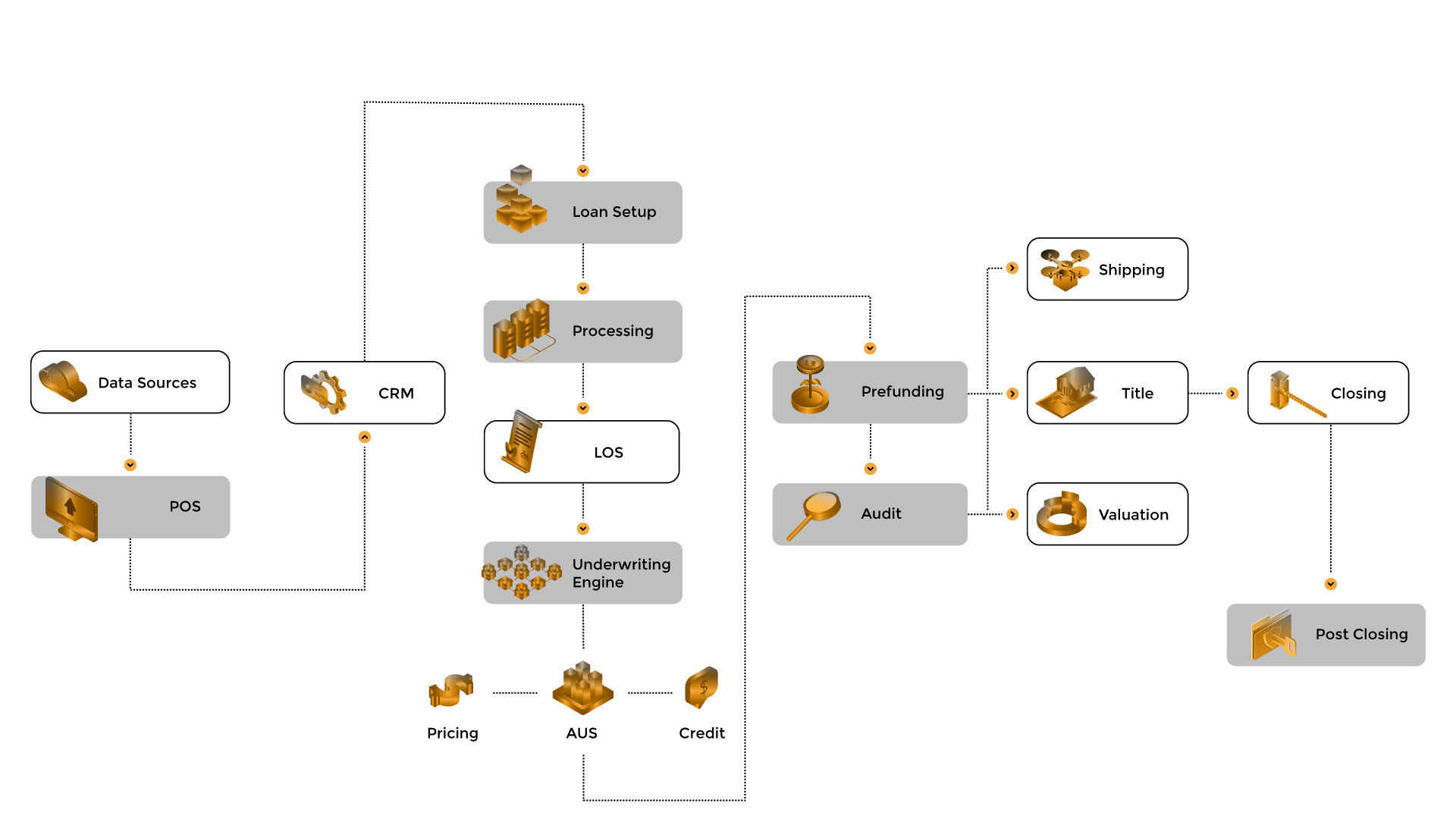

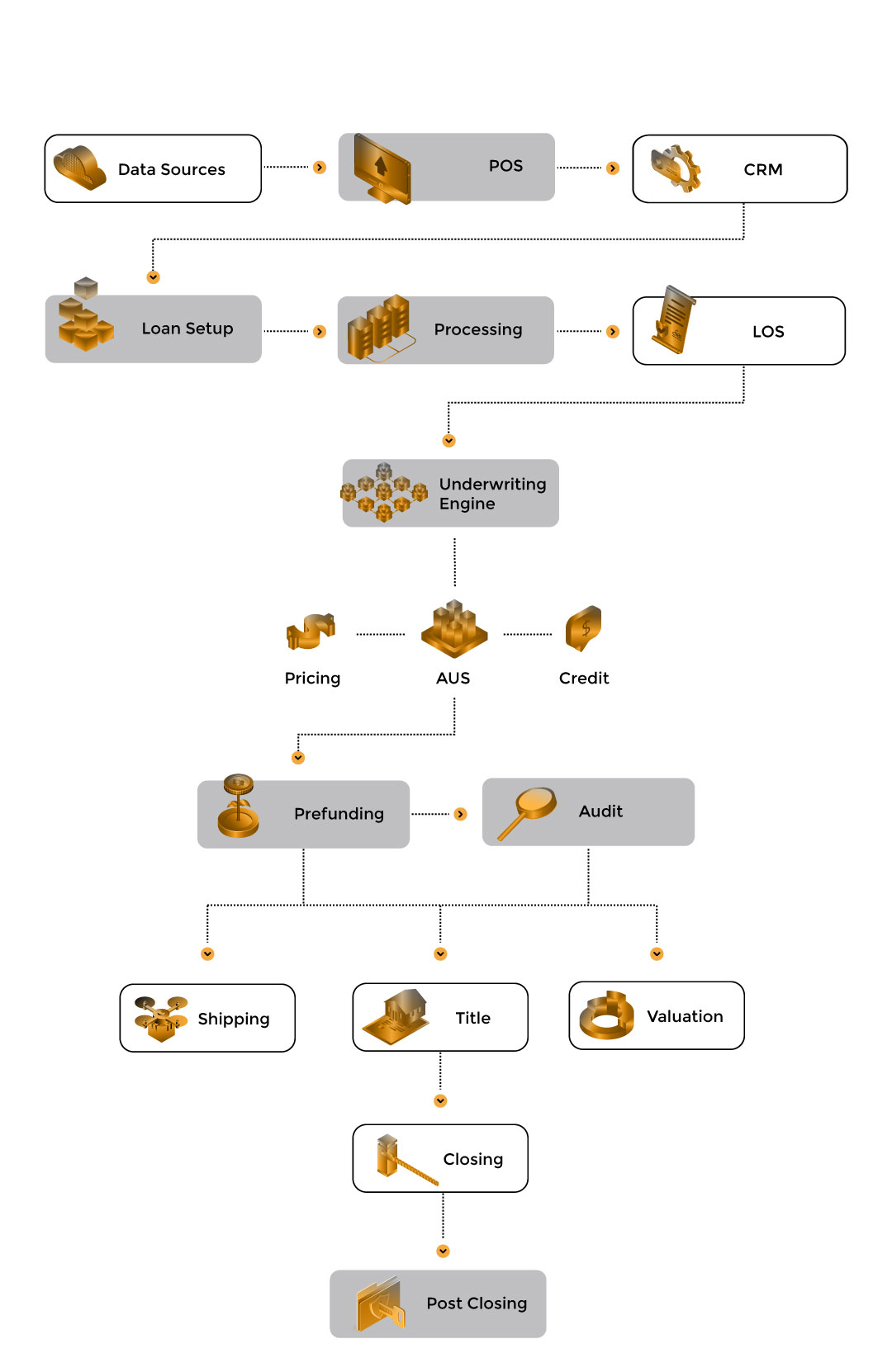

Applications

DocVu.AI Capabilities

Applications based mortgage

Mortgage underwriting

Mortgage Appraisals and Valuation

Reporting and Analysis

Maximize loan approvals with a document processing automation solution, DocVu.AI.

Improve your document processing speed and enhance your data extraction efficiency using DocVu.AI

Case Studies

Stay informed with the latest on the Industries we work with and news updates from our company.

How DocVu.AI Revolutionized ‘Order to Cash Process’ for a Leading Pharma Chain

Please submit this form to download Case Study

Bank in North America to Achieve Excellence in Post-Close Audit using IDP solutions

Please submit this form to download Case Study

Knowledge Centre

Keep updated with our resources on mortgage industry and the latest company updates

DMSVu vs. traditional DMS: A paradigm shift in document automation

In the relentless world of mortgage lending, document chaos is the enemy within. A recent Forbes report laid bare the

7 emerging trends redefining post-closing audits in the digital mortgage era

When Wells Fargo disclosed a $37 million regulatory penalty in Q1 2024 due to post-closing audit failures, as reported by

How cloud-based document management enhances security and scalability in finance & accounting

In April 2024, Bloomberg revealed a 45% year-over-year surge in cyberattacks targeting financial institutions still reliant on on-premise document systems,

How would you like to partner with us?

Want to know how DocVu.AI makes document processing efficient? Get in touch with us!

Frequently Asked Questions

The mortgage application process involves several key steps.

- Prequalification

- Documentation

- Loan Application

- Credit Check

- Appraisal

- Underwriting

- Closing

Throughout the process, the borrower works closely with the lender, providing additional information or documentation as required.

The mortgage processing journey is not without its challenges. Some common hurdles include the following:

- Documentation: Gathering and verifying the required documents from borrowers can be time-consuming and complex.

- Compliance: The mortgage industry is subject to various regulations and compliance requirements.

- Communication: Coordinating and maintaining effective communication between multiple parties involved can be challenging.

- Manual processes: Reliance on manual data entry and paper-based workflows can lead to errors, inefficiencies, and delays in mortgage processing.

- Changing guidelines: Mortgage guidelines and requirements can change frequently, requiring lenders to stay updated and adapt their processes accordingly.

- Time constraints: Meeting tight deadlines and turnaround times can be demanding.

Automation can significantly enhance the mortgage processing journey by streamlining and improving various process aspects. Here are some ways automation can bring improvements:

- Automation streamlines document collection and verification, reducing manual effort and errors.

- Workflow automation improves collaboration between stakeholders, reducing delays and improving turnaround time.

- Automation ensures compliance by validating documents, verifying identities, and monitoring regulatory requirements.

- Integration with systems and databases automates data entry and improves accuracy.

- Automated communication systems provide timely updates to borrowers, enhancing the customer experience.

- Automation improves efficiency, reduces costs, and increases customer satisfaction in mortgage processing.

Here are a few of the benefits of mortgage processing automation using DocVu.AI:

- Time savings

- Enhanced accuracy

- Compliance assurance

- Improved customer experience

- Cost savings

- Efficient resource utilization

Overall, mortgage processing automation with DocVu improves efficiency, accuracy, compliance, customer experience, and cost-effectiveness, making it a valuable tool for lenders in the mortgage industry.

There are several common types of mortgage fraud. Here are a few examples:

- Income Fraud: This occurs when a borrower intentionally provides false or exaggerated income information to qualify for a larger loan amount.

- Occupancy Fraud: This involves misrepresenting the occupancy status of a property. For example, stating that a property will be the borrower’s primary residence when it is actually used as an investment property.

- Appraisal Fraud: This occurs when a property’s value is intentionally inflated or deflated to manipulate the loan amount or deceive lenders.

- Straw Buying: In this scheme, someone with good credit pretends to be the borrower and applies for a mortgage on behalf of someone else who wouldn’t qualify for the loan.

- Identity Theft: This involves using someone else’s personal information, such as their Social Security number, to apply for a mortgage without their knowledge or consent.

- Silent Second: This occurs when the seller of a property secretly provides a second mortgage to the buyer, which is not disclosed to the primary lender.

These are just a few examples, and mortgage fraud schemes can be quite elaborate and creative. It’s important to be vigilant and work with reputable lenders and professionals when obtaining a mortgage.